Rights issues are often misunderstood by private investors.

The problem is that there’s little information about rights issues in clear and easy to understand language.

In this article, I will explain what rights issues are and how rights issues work in shares.

Equipped with this knowledge, you can take advantage of rights issues in a market that often misunderstands them.

Let’s begin…

What is a rights issue?

A rights issue is an offer to existing shareholders to subscribe for new shares in proportion to their existing shareholding. Rights issues can have a big effect on a company’s share price because of the new shares being issued. This is known as dilution and occurs when the issued shares are admitted to the London Stock Exchange.

How does a rights issue work?

A rights issue is undertaken by a company looking to raise cash by issuing new shares to existing shareholders. The shareholders have the right to buy new shares in the company in proportion to their existing shares. These shares are known as “rights”.

However, existing shareholders have the right and not the obligation to buy these new shares.

Shareholders have four options when presented with a rights issue:

- The existing shareholders can take up all of their allocated rights.

- The existing shareholders can sell all of their rights for cash.

- Existing shareholders can also sell some of their rights in order to finance the purchase of new shares in the form of rights (also known as tail-swallowing).

- Existing shareholders can also do nothing. In this option, the company will sell the rump (rights that have not been subscribed for) and shareholders will receive the cash proceeds.

As there are new shares coming onto the market, the total shares in issue increases. This means that the company’s profits per share are diluted. The rights issue offers existing shareholders the option to stand their corner and maintain their proportionate shareholding of the company.

What are nil-paid rights?

Nil-paid rights are the rights shareholders receive when a company undertakes a rights issue. These nil-paid rights are tradable through the nil-paid shares that existing shareholders are allocated shortly after the ex-rights date.

These rights are like tokens which entitle you to buy more shares at a discounted price. This ‘token’ is transferable and if you don’t want it then you can sell it.

Rights issue example

Let’s suppose that Tesco plc undertakes a rights issue (this is an example).

We own 10,000 shares, and the stock is currently trading at 100p. The company decides to raise more money and so Tesco plc announces a rights issue for existing shareholders at a price of 50p per share.

The company offers existing shareholders to buy additional shares in Tesco plc at a 2 for 10 offer. This means that existing shareholders can buy 2 new shares in Tesco for every 10 that they currently own.

As we have 10,000 shares, the rights issue means that we have the right to buy 2,000 new shares in the company at 50p for a total consideration of £1,000.

The nil-paid rights only exist when the original shares trade ex-rights. This is the day that the new shares are admitted to the market and the price of the equity factors this into its share price.

This is very similar to when a stock falls on the day of its ex-dividend date. For example, if a stock is priced at 50p and paying a 5p dividend, then once the stock trades on its ex-dividend date the market price will likely drop around 5p as shareholders in the previous session will receive this dividend.

Why would a company do a rights issue?

A company will offer its existing shareholders a rights issue to buy new shares in the company in order to raise capital.

Many companies often do equity placings that dilute all shareholders but the rights issue protects existing shareholders by allowing them to take up or sell their rights. This is different from an open offer where if shareholders do not take up their entitlement they do not receive any cash return.

How does a rights issue affect share price?

A rights issue affects the share price because there are new shares which increase the number of shares in issue. These new shares in issue have been sold at a price lower than the previous market price. This is dependent on the number of rights that the company offers out to its existing shareholders.

Rights issues are usually done when a company needs more capital. It is therefore a sign that the company could be in trouble, and this can have a negative effect on the stock price.

It can also be a sign that the company’s profits are in distress.

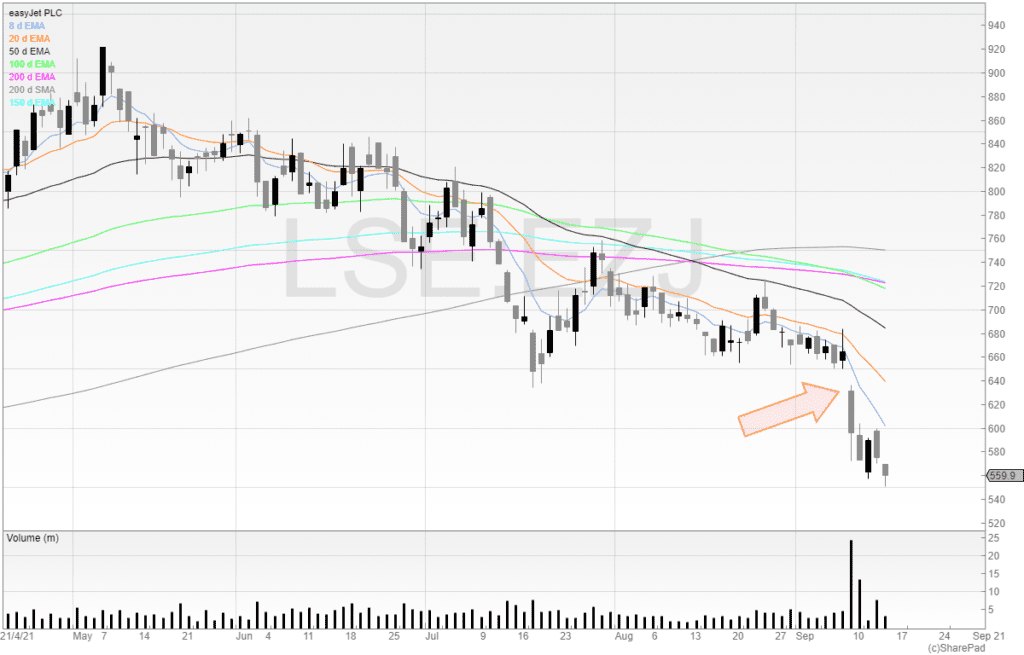

On 9 September 2021 easyJet announced a rights issue.

Below is the chart of easyJet (EZJ). I’ve marked an arrow on the morning the rights issue was announced.

We can see that the price reaction was negative (although is not always the case).

Easyjet announced a fully underwritten rights issue to raise gross proceeds of around £1.2 billion through the offer of 301,260,394 New Shares.

This makes the offer 31 New Shares for every 47 Existing Shares.

This means that for every 47 shares of easyJet that shareholders owned, they’d be offered the right to take up 31 new shares at 410p.

Many private investors make the mistake of assuming that the share price should fall to 410p – the price of the rights – but this is not the case.

This is because when the rights issue is announced the stock is trading cum rights, or before the rights have come into effect.

To be able to be eligible to receive the rights, existing shareholders and other potential shareholders must be holding the stock on the ex-rights date.

We can see from easyJet’s RNS announcement below that the ex-rights date is 10 September 2021.

This means that anyone wishing to qualify for the rights must’ve been holding easyJet stock at the close on 10 September.

In theory, there should be no difference in the value of holding easyJet stock at the close on 10 September 2021 and receiving the rights and the value of holding easyJet stock at the open on Monday 13 September 2021 when the stock is ex-rights, because the market will efficiently open the stock at its ex-rights price.

Is a rights issue good or bad?

A rights issue is neither good nor bad for a company although it is often a sign that a company is struggling because it means it is raising more capital. However, it could also be because the company wishes to fund an acquisition, such as Future plc’s acquisition of Purch back in 2018.

A rights issue is neither a good nor a bad thing – it is what the capital is being used for that is important.

It also matters on market sentiment and perception. If the company was expected to go bust, then the announcement of a rights issue can provide stability and much-needed cash for the company. This can see an increase in the company’s share price.

Advantages of a rights issue

One advantage of a rights issue is that it can shore up a company’s ailing balance sheet and provide an injection of cash into the company’s coffers.

This capital can be used however the company believes it can create value and sometimes a rights issue can be the starting point of a turnaround in a company.

Another advantage is that it offers all shareholders the opportunity to take part in the capital raise.

In an equity placing, the shares are sold to both new and existing shareholders. This can leave some current shareholders disgruntled if they were not able to take part in the opportunity to buy more stock at a discount.

Disadvantages of a rights issue

There are several disadvantages of a rights issue. Firstly, it is going to increase the number of shares in issue. This is dilutive and so will have an effect on future earnings per share of the company.

However, existing shareholders can retain their percentage of equity by taking up their rights and buying new shares.

Another disadvantage of a rights issue is that if the rights are not well taken up then the rump can provide an overhang in the stock. This means that there would be a lot of new shares waiting to be sold and so it may prevent the price from rising.

This can further be exacerbated if existing shareholders sell their existing shares when news of the rights issue breaks as they interpret it as a negative for the company.

Trading rights issues

It is possible to trade rights issues profitably as rights issues are often misunderstood by the market.

Rights issues are done to raise capital for the company. A discounted price seems more attractive than a higher price, even if it is exactly the same result in terms of dilution.

In the example of Rolls Royce, the rights issue is asking existing shareholders to buy 10 shares for every 3 they already own at a price of 32p. If Rolls Royce asked existing shareholders to buy more shares at 142p on the basis of 3 new shares per 4 existing shares would the company get the same interest? Perhaps not.

For a period the nil-paid rights will trade on the stock market. This can create arbitrage opportunities.

We will come back to this later.

When a stock is trading cum rights (that is, before the rights have come into effect), we can use the current close price of the stock to calculate the price of the stock when it trades ex-rights (after the rights have come into effect).

This is also known as the Theoretical Ex-Rights Price, or TERP.

How to calculate the Theoretical Ex-Rights Price

The Theoretical Ex-Rights Price is the price that the stock should theoretically trade at once the stock is ex-rights.

Remember, the current share price cum rights has nothing to do with the rights issue.

With TERP we are trying to find (assuming all things being equal) the new share price the stock will trade at post-rights.

This is only theoretical because share prices are always moving due to market sentiment.

To calculate TERP, we need to use this formula.

TERP = ( (number of new shares * issue price) + (number of existing shares * previous day close price) ) / Total number of shares post rights

As the share price is constantly changing before the rights are admitted, TERP changes on a daily basis.

In the example of Rolls Royce, the close on 7 October 2020 was 158p. We can use this price to calculate TERP.

We only need the information on the rights, and so we don’t need to labour and find out all the information on outstanding and new shares.

We know that Rolls Royce will be issuing 10 new shares for every 3 shares held.

TERP = ( (number of new shares * issue price) + (number of existing shares * previous day close price) ) / Total number of shares post rights

TERP = ( (10 * 32p) + (3 * 158p) ) / 13 = 61.1p

Therefore, TERP is 0.61p at a closing price of 158p.

Using TERP when the rights trade separately

We can use TERP to analyse where the rights should theoretically be trading at.

In the Rolls Royce example above, let’s assume that the rights begin trading on a Rolls Royce close price of 158p.

Buying the rights is a call option granting us the right to subscribe to the stock at 32p.

We can then use another calculation to see where the rights should be trading at all things being equal.

TERP – issue price of new shares

61.1p – 32p = 29.1p

This would give us an indication that the rights should trade at 29.1p. Naturally, the rights price fluctuates based on Rolls Royce’s current share price.

Building in profit this way on trades is called arbitrage. But we could also just buy or sell the rights in order to try and profit from a reversion to the mean trade.

Nothing is ever guaranteed, but we can try to trade rights in this way when there is a discrepancy between the rights price and the share price.

Can I buy rights in my Stocks & Shares ISA?

You can exercise rights in your Stocks & Shares ISA.

However, if you own a stock that is issuing additional shares in your ISA (Individual Savings Accounts are tax-free and you can read more about them here then this can present a problem.

The reason for this is because if you have maxed out your ISA allowance (currently £20,000 per annum) then you can’t add additional capital in order to take up your additional shares.

Luckily, there is a solution here, as we can tail-swallow and sell some of our rights and use the proceeds to fund our entitlement.

In order to know how the number of rights we need to sell to fund our additional shares, we need to use TERP again in the following calculation.

( Rights * subscription price ) / TERP

When using this calculation we need to round down to the nearest whole share. If we don’t, then we will have additional capital available that will not cover the purchase of a whole share.

Should I take up my rights?

This is entirely dependent on your own risk profile and on the rights issue. What is important is what the capital is being used for by the company. For example, a rights issue in order to provide much-needed working capital to keep the lights on is clearly very different to a company raising capital to fund an earnings enhancing acquisition.

However, many private investors feel they ought to hold their stock in order to benefit from a ‘discounted’ rights price.

But as we know from looking at TERP, there is (assuming all things being equal) no difference between holding stock at the close of the cum rights period or buying shares at the start of the ex-rights period.

The market factors in the price of the rights and therefore one shouldn’t make the mistake of assuming that they need to hold for the ‘benefit’ of the rights.

As a friend in the market once said: “A special deal for loyal shareholders they are not!”.

Final words

Rights issues do not need to be confusing.

By understanding how rights issues work along with the issuance of new shares and the theoretical ex-rights price (TERP) we can potentially trade rights issues profitably.

Investors should weigh up each rights issue on its own merit, as well as their own risk profile.

DISCLAIMER: This article and website is not (nor should it be used as) financial advice. The author trades and invests his own money in the stock market and this article is for education only. None of the companies and stocks mentioned in this article are recommendations to buy or sell and are used for examples only. You must do your own research and seek professional advice if you are unsure of what to do.

Become a better trader with SharePad. Use SharePad’s technique analysis suite and filtering to find stocks to trade. SharePad gives me an advantage over the market and you can take a risk-free trial through me. Find out more