Having the knowledge and being able to implement the correct spread betting strategies is what sets apart successful and constantly profitable spread bettors.

In this article, I’ll lay out my best spread betting tips that I’ve utilised over the past few years to trade spread bets profitably.

Top 10 spread betting tips

- Understand your spread betting platform

- Know your market and spread betting strategy

- Trade the trend

- Run your winners for higher profits

- Cut your losses

- Use stop losses

- Deploy guaranteed stop losses when necessary

- Use position size

- Be disciplined

- Backtest your results and improve

1. Understand your spread betting platform

Any spread betting trader should plan their spread betting in advance.

You should be able to competently navigate your spread betting platform so you are prepared should you need to act quickly.

If you’re yet to create your spread betting account, read my article on the best spread betting brokers to help inform your decision. In the article, I review the top brokers in the UK and provide my thoughts on each.

Understanding the platform will help your spread betting as you’ll be able to take full advantage of what the platform provides.

For example, IG Index’s spread betting platform has the benefit of guaranteed stop losses.

This means that the maximum loss is guaranteed when using this type of stop loss. It also offers trailing stops, which means we can place our stop a certain amount of points below the highest price of the stock.

As the stock rises, so too does our stop, and this allows us to capture and bank more gains and profits (more on stop loss later).

2. Know your market and spread betting strategy

A useful tip to start spread betting is to know your market and spread betting strategy before you start using real cash.

Most traders lose when trading spread bets because they don’t know what they’re trading and they don’t have a specifically defined strategy.

If you want to trade stocks and shares then take the time to understand how the London Stock Exchange operates. It is far better to do so before you lose money because you don’t know what you’re doing.

IG Index offers both live and demo accounts in order for us to practice before going live.

Having a clearly defined spread betting strategy will prevent us from jumping into positions at random and losing our money.

One way to do this is to trade specific patterns that are profitable repeatedly rather than gambling on stocks going up or down.

One profitable trading strategy is the breakout pattern… the bread and butter of my trading!

A breakout is when the price “breaks out” of a previous resistance range.

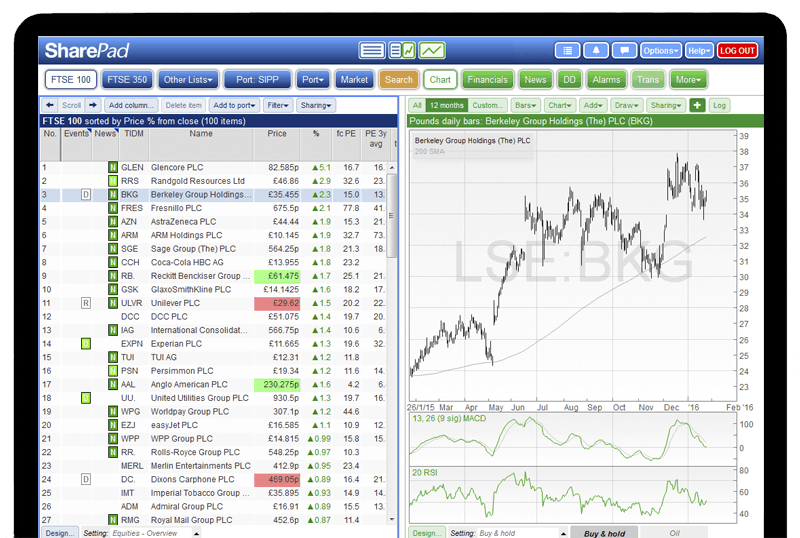

For example, in the SharePad chart below we can see the price breaking out of the red resistance line I have drawn on the chart:

As you can see, buying the stock as it broke out led to an excellent risk/reward trade which delivered a high profit…

(You can learn how to trade breakouts in detail from my free breakout guide.)

3. Trade the trend when spread betting

An excellent tip to abide by when spread betting is to always trade the trend.

This is because spread betting is a leveraged product and this magnifies both your gains and your losses.

By trading the trend when spread betting, you ensure that you’re trading with the wind in your sails rather than fighting an uphill battle.

Whether you are trading over a 1-minute timeframe or a daily timeframe, it’s always best to enter the trade in the direction of the trend.

Doing otherwise is betting on the price switching direction.

There is a well-known trading cliche on doing this: catching a falling knife.

4. Run your winners for higher spread bet profits

Running your winners is a useful tip not only in spread betting but trading in general.

When you place a trade, there are only ever four outcomes:

- Small loss

- Large loss

- Small win

- Large win

You want to remove large losses and instead focus on netting small wins and big wins.

The best way to achieve large wins in your spread bet account is to run your winners. This means letting your trades run and not selling too early.

By trading with the trend, you increase the chances of making tax free profits.

5. Remember to cut your losses

Cutting losses is one of the most important parts of trading. It is an oft-repeated mantra yet many traders blow their accounts because of an ability to cut their losses.

Losses work against you exponentially. For example, if you are 33% down on a trade, you then require a 50% move just to get back to breakeven.

Spread bets are also leveraged, which multiplies losses. This is bad for both your physical and psychological capital, so ensuring your losses are kept small is a useful spread bet tip to remember.

6. Use stop losses when spread betting

By putting a stop loss on your spread bet trade, it means you will be closed out of the position if the price should hit that level.

This protects your downside and reduces your total risk. Stop losses are a great tool for both novices and intermediates when it comes to spread betting.

By planning your stop losses ahead of placing your spread bet trade, you ensure that you’re acting rationally. Far too many traders are unable to control their emotions when spread betting and so they end up losing money and blowing their accounts.

PRO TIP: Use guaranteed stop losses when volatility in the market spikes.

7. Deploy guaranteed stop losses when necessary

Guaranteed stop losses in spread betting are stop losses only they are guaranteed by our spread bet broker.

Normal stop losses can sometimes fail to trigger because the price gaps down through your stop, for example, in the event of a profit warning where the price opens up down well below your stop loss.

Using a guaranteed stop loss means that your stops are protected by the spread bet broker and that even if the price gaps through your stop your risk and downside is still protected.

Use guaranteed stops in spread betting when volatility in the market is higher and the chance of stop slippage is increased. By protecting your downside, you’re ensuring that you’re cutting your losses and not exposing yourself to a large potential loss.

8. Use position size for success

Spread betting requires margin in order to open a trade as it is leveraged. This means that you can make your capital work harder but as you saw earlier in the article, it is a leveraged product.

With a retail spread bet account, we often have 5:1 of leverage. This means that with a £10,000 account, you can take a position of £50,000. But just because you have access to leverage, it does not mean that you have to use it.

If your £50,000 position increased by 20%, then you would have a position of £60,000 and therefore your £10,000 capital would’ve returned a 100% profit of £10,000.

But this always works both ways – if your £50,000 declined by 20%, your capital would be wiped out and your spread bet account blown.

Therefore, you need to take into account volatility of the stock when placing spread bets.

You also need to look at your stop loss placement as you can adjust our position size based on your stop loss.

For example, if you are employing a wider stop loss on a spread bet trade, then you can reduce your position size in order to keep your risk on the trade constant.

9. You need to be disciplined

The best spread bet traders are disciplined and consistent. They know that to profit from spread betting they need to do all of the above.

You are only ever one trade away from blowing your spread bet accounts.

By having a strategy that works and is repeatable and profitable, you can slowly grow and compound your spread bet accounts.

10. Backtest your spread bet results and improve

Successful spread bet traders are always looking to improve their results. One way of doing this is by reviewing your trading journal and analysing your trades…

Are you having difficulty cutting losses? What is happening when you close your profits? Are you trimming your profits too early?

Once you know what is going wrong then we can focus on it and improve.

I use SharePad in order to do all of my charting and backtesting, it’s an extremely powerful software.

You can claim your risk-free trial and one free month here.

Conclusion

Most traders lose when spread betting so with these ten tips, you can hopefully protect your capital and compound our accounts.

Don’t go into spread betting unprepared. IG Index offers a demo account so that you can trade and learn the platform without risking real capital.

You can also use this account in order to get to know your market that you trade and practice getting onboard and trading trends.

Many spread bet providers also offer guaranteed stop losses that you can use to your advantage.

If you are a new trader or looking to sharpen your edge, my UK Online Stock Trading Course will help you to do just that.