Bonus Material:

Level 2 trading data is often assumed to be a crystal ball by retail investors. Sadly, this is not the truth. Moreover, Level 2 is often heavily misunderstood which means traders are acting on wrong information causing harmful losses.

This article will explain how Level 2 works and how you can use it to benefit your trading. Firstly, we need to understand exactly what Level 2 is and what it does before deciding to include it in a trading strategy.

What is Level 2?

Level 2 trading (or Level II) is the electronic order book for listed stocks, which can be accessed by traders and investors through subscription-based services. Level 2 shows a ranked list of the best bid and ask prices, orders from all market makers and market participants, and order sizes.

How does Level 2 work?

Level 2 trading (level 2) provides market depth in a stock as it allows us to see all of the available orders in the market for that stock which create the price level. This ranks prices at their most competitive on the bid and ask, and also includes order sizes too.

The bid price shows the best bid in a list of the most competitive buy orders in descending value and the ask price will show a list of the most competitive sell orders in descending value.

It works by collecting all of the market orders and displaying them onto one Level 2 screen so traders and investors can see the market as it is in action.

We will see the share price in the current bid/ask as listed on the touch – the strip above all of the orders that displays the number of shares in both the bid and the ask.

Level 2 has made the stock market more transparent for all market participants and as a result, it has increased liquidity. However, it used to be exorbitantly expensive and therefore only a real option for larger market buyers and sellers.

With many competitively priced Level 2 data packages, you should decide if Level 2 will offer you an advantage in your trading.

Should you use Level 2 when trading?

Many traders have the mistaken belief that Level 2 access offers a crystal ball and the ability to predict short-term price movements.

If that were the case, then after staring at Level 2 screens on a daily basis for years now I would have retired to my Caribbean island where I drink pink gin and tonics all day. As that has not happened, it is clearly not true.

For active traders and intraday traders (day traders), then Level 2 is a necessity. It would be like driving with your eyes closed.

Day trading relies heavily on volatility, intraday price action, and the market in real-time, therefore it would be impossible to trade without Level 2 market data. It is necessary in order to make trading decisions.

In this section, we’ll look at both the advantages and disadvantages of using Level 2 data.

Advantages

Level 2 shows the market as it is and if you want to gain or work a better entry into a trade or direct your order towards a specific market maker then you will find Level 2 offers you an advantage.

Being able to see the live prints is also advantageous as we can see what is happening.

For example, if the prints are below the bid we can assume that either a seller is desperate to get out or that the market makers are not offering a strong online bid (or both).

We may be able to work out that there is plenty of stock on offer to buy too as the buying prints are nowhere near the full ask and so we can see that the market makers are happy sellers of the stock.

If you deal with a telephone broker, you can also direct your orders specifically to a market maker. This is useful because the market makers are obliged to honour Level 2 quotes when dealt with over the phone.

This is not the case when dealing and trading through an online broker.

Disadvantages

In my opinion, there is no disadvantage to Level 2 data other than the potential to read too much into it. However, this is a flaw of the trader and not the tool itself.

Investors may not find so much use for Level 2 as they are more focused on the fundamentals of the stock and buying and selling over the long term.

But even investors want to get the best prices possible for their buys and sells.

How to read Level 2 data

Level 2 data is available in the UK for both of the London Stock Exchange’s trading platforms. There are two types of Level 2 screens for the two trading platforms.

- SETS (Stock Exchange Electronic Trading System)

- SETSqx (Stock Exchange Electronic Trading System Quotes and Crosses)

SETS Level 2

SETS (Stock Exchange Trading System) is the London Stock Exchange’s flagship electronic order book and is used to trade FTSE 100, FTSE 250, and FTSE Small Cap Index constituents. Other London listed securities can also be traded via SETS.

SETS offers a wide discretion of trades to be placed and is a liquid and electronic order book.

Stocks that trade on SETS allow direct market access and the ability to place trades directly onto the order book at your desired price. This allows us to take the place of a market maker as we can bid to buy others’ shares as well as placing our own stock on offer too.

The versatility of SETS allows various buy and sell orders to be placed into the market.

SETS Level 2 example

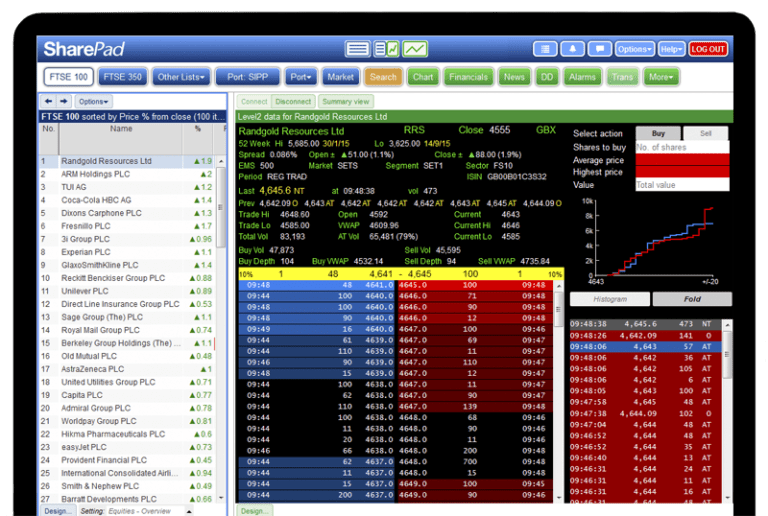

Below is a Level 2 SETS window from ShareScope.

Level 2 shows the market as it is live. In this window, we can see lots of information, including:

- Bid and ask side

- Market depth

- Time

- Size

- Date of trades

- Information about the stock

At the top of the window, we can see the company name, its EPIC code (GRG), and the previous closing price.

The yellow line is known as the strip, or the ‘touch’. The touch displays the highest bid and ask price (1,637 – 1,641).

We can see that on the left of 1,637 we can see the numbers “6” and “423”.

These numbers refer to firstly the number of bidders at the price of 1,637 and the market depth of the bidders at this price.

In this instance, we can see from the touch that there are 6 bidders with a total of 423 shares being bid at 1,637p.

On the other side of the touch, we can see that there is only a single seller in a size of 80 shares at 1,641.

You may be wondering why there are a lot of orders underneath at a more competitive selling price than the one displayed on the touch. These orders are orange, which means they were being deleted as the screenshot was taken.

Some orders on the Level 2 window are green, which means they were just being added at the time of the print screen.

Beneath the bid side and the ask we can see the full market depth. It shows the most competitive bids in descending orders with the prices and sizes, and on the right, we can see the most competitive asks in higher prices.

We can use this information to assess the market depth and also place our own orders onto the order book. I show how to do this in my free ebooks which are available below.

One advantage of using Level 2 on SETS is that we can see the current price, and if we want to work a large order at a specific price then we can use the iceberg functionality.

An iceberg order is an order that is split into tranches and reloaded through the use of an automated program. Icebergs are useful to have in stock trading as buying or selling large orders can have an effect on a stock’s price.

Icebergs can be useful for short-sellers as they soak up the bid and remain the highest price as each tranche is reloaded (unless someone outbids them – remember the highest bidder is the highest price).

Not all stock brokers offer this, however, I use it with IG Index.

Trades column on Level 2

On the right-hand side of the Level 2 screen, there is another column that shows a list of prints both in red and blue. The red orders are printed as sells and the blue orders are printed as buys.

This is the list of recent trades and their market prices with the time printed on the left-hand side of the order.

We can see that on the right-hand side of the print there is a two-letter code, either AT or OB. These are called “trade codes”.

There are several trade codes which we can learn to identify.

AT = Automatic Trade

Automatic trades are trades that are automatically matched on the SETS electronic order book.

For example, if someone had 10,000 shares on offer at 600p, and I bought those shares using direct market access, the trade would print in the market as a buy with an AT trade code.

Even though the trade was also a sell, it’s the offer is hit then it is printed as a buy and if the bid is hit then the stock is printed as a sell.

OB = Off-Book Trade

An off-book trade is a trade that hasn’t matched electronically on SETS and is done via market makers on the RSP.

Download the free ebook now

Enter your email to receive my free UK stock trading handbook, packed with professional techniques to manage risk and consistently profit on AIM stocks.

SETSqx Level 2

SETSqx (Stock Exchange Trading System with Quotes and Crosses) combines a market maker driven model with an electronic auction book at specific points in the day.

This system is primarily a market maker driven as we are only able to access the order book at certain times of the day.

SETSqx also has an opening auction and at 08:00 until 16:30 the market makers registered to deal in the security are obliged to offer firm quotes to buy and to sell in that stock. SETSqx live data can be viewed again with a Level 2 subscription.

Often in shares that only offer market maker trading and no direct market access other than the auction the liquidity is lower. This is because dealing only takes place via market makers and we have to buy and sell at the prices they offer and provide.

SETSqx Level 2 example

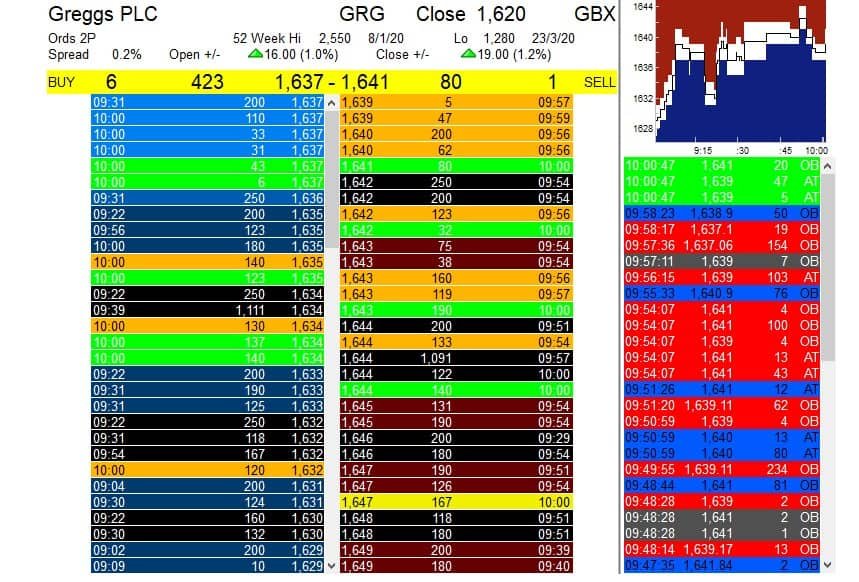

Below is a Level 2 screen from a SETSqx stock.

You will notice that there is a lot less information here. This is because to trade SETSqx stocks we need to trade through market makers.

Market makers are specific firms that take on market risk by offering a two-way price in order to provide liquidity to us.

In return for that risk, they make the spread on stocks. The spread is the difference between the buy price and the sell price. In this case, we can see that the spread is 10p as the bid is 270p and the ask is 280p.

At the touch, we can see codes instead of the orders that appear on SETS. These codes are the market maker mnemonics.

In this Level 2 screen we can see:

- SING = N+1 Singer

- SCAP = Shore Capital

- PEEL = Peel Hunt

- INV. = Investec

- WINS = Winterflood Securities

On other Level 2 screens you may see:

- JBER = Berenberg

- CFEP = Cantor Fitzgerald (sometimes CFEQ on some Level 2 providers)

- STFL = Stiefel

- NUMS = Numis Securites

- FCAP = finnCap

- CNKS = Cenkos Securities

- PMUR = Panmure Gordon

These market makers all offer two-way prices on the stocks they cover on Level 2 screens.

Next to the market maker mnemonic is what is known as the Normal Market Size or NMS (it is now officially called Exchange Market Size or EMS but everyone still uses NMS).

This is the size that the market makers are obliged to deal in when dealt with over the telephone.

In this example, if we were to use our phone broker to buy or sell shares in Eagle Eye, then the market makers would be obliged to deal up to 1,500 shares at the price they are quoting on the Level 2 screen.

However, the market makers are not obliged to deal in NMS when dealt with over an online execution broker.

This is a key difference between dealing over the internet and dealing through the phone.

Market makers know that most traders and investors don’t deal through the phone and so they are able to use this fact to their advantage.

The market markets will position themselves on Level 2 at a price which they are not offering on the Retail Service Provider (RSP). The RSP is the service that connects us and the market makers in order to deal.

Let’s look at the SETSqx Level 2 screen again.

We can see that there are three market makers positioned on the bid at 270p (SING, SCAP, and PEEL). We can also see on the ask that there is only one market maker (INV.) offering 280p.

If we ask our phone broker to go directly to the market makers, these are the prices and minimum sizes they’d be obliged to deal in.

But if we deal over the RSP, we might find that SING is bidding 250p and selling at 276p.

Why would they do this?

Firstly, by making the stock look well bid it encourages market participants to buy. And if the market maker is a seller then it makes sense to market the stock attractively on Level 2.

Remember, most market participants don’t use a phone broker and so they will get away with this trick more often than not.

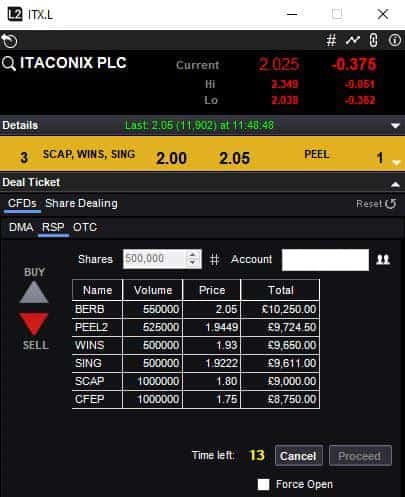

Here is an example of a Level 2 screen of a stock called Itaconix.

We can see that there are three market makers on the bid, and we can see that SCAP moved up their pricing at 11:39 – the most recent market maker change.

It would be wrong to assume that because there are three markets on the bid on Level 2 this means the stock is well supported.

Let’s take a look at an RSP ticket from IG’s L2 Dealer.

The RSP ticket paints a different picture.

We can see that Berenberg (BERB) are very keen to buy stock from us (remember we sell to the market makers who buy our shares) and will bid us 500,000 shares at the asking price! However, none of the other market makers is firm at 2p.

This could also be due to the size of the quote. The Normal Market Size is only 25,000 shares and this quote is way above the trading sizes going through on the Level 2 screen.

Using various order sizes will show market makers at different prices and help to give an idea of how well a stock is bid and offered. But as it is clear, using Level 2 alone is not enough to gauge the market.

PRO TIP: When checking market depth it is important to vary up the quote sizes to build an idea of supply and demand.

Therefore, Level 2 is of diminished value when dealing with an online broker as we may not be able to buy at the prices displayed online. However, if you have a phone broker it can be extremely useful as you can direct your orders to specific market makers.

In short term trading, Level 2 can be used to see how the market makers are lining themselves up on the order book.

Market makers will often follow each other when ticking up and down, and so if we see one market maker begin to tick up after a fall then we can guess that others will follow.

Market maker tree shake

Market makers are there to provide liquidity for the market takers, however, we must remember that the market makers are also there to make a market for themselves. Market making is not a charitable activity and so we know they make their money on the spread.

Therefore, the market makers can be incentivised for people to trade in order to make a financial turn on each trade – buying from one person cheaper to sell to another with a markup.

One of the best ways to invite people to trade is by marking the stock lower and causing a drop in the mid-price. This can spook private investors who mistakenly believe the stock is falling for a reason and so sell their shares to the market makers.

Once the market makers have their fill they will then run the stock back up to its original price.

This tactic is called a tree shake. Market makers also know where many retail traders will typically place their stops, and so they will shake the price about in order to trigger these.

Here is an example of a tree shake in action.

We can see from the intraday chart (from ShareScope) that the price was roughly 18.3p at 08:00. The price then fell to 17.6p in four ticks and then ticked all the way back to the same price in the first two hours of trading.

The market makers dropped the price to pick up stock and then ran the price back up selling the cheap stock to others and collecting a turn on the spread too.

We should always be wary of tree shakes as this is a common market maker tactic.

Understanding Level 2 data

Level 2 data gives you a full view of the order book in order to see market depth underneath the stock’s bid and offer price. It also allows us to see market maker quotations in the market for that share.

Therefore, Level 2 provides greater insight into a stock and can also offer us the opportunity for more astute buying and selling when combined with RSP quotes.

Level 2 allows us to see the market as it is live. This can help us place smarter orders onto the order book because as well as requesting a quote from the market makers we can also place our trades directly onto the market in SETS stocks.

This means we become a market maker on one side of the Level 2 screen as we are either bidding in the market for stock or offering a price to sell our stock to new buyers.

To do this requires a broker with Direct Market Access capability. The main broker that offers this in the UK is IG. You will need to open either an ISA or a CFD account.

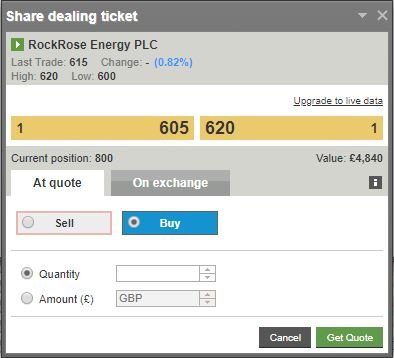

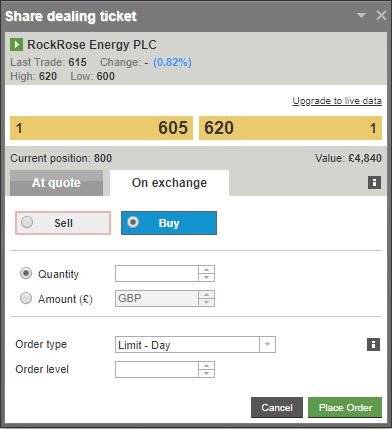

To do this with IG, let’s look at the share dealing ticket again. This is a ticket taken from IG’s web dealer platform.

Instead of ‘At Quote’, we now click ‘On Exchange’. This now opens a new set of options.

To place a trade on the exchange, we must again enter either our monetary amount or the number of shares we wish to purchase (or sell if we already own them), but unlike on a quote we set our own price.

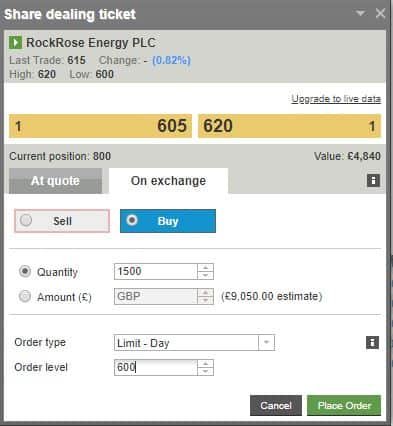

In this example of the dealing ticket we are going to place an order to buy 1,500 shares of Rockrose Energy with a limit price of 600p.

Once we have placed this order, we should get confirmation that our order has been placed.

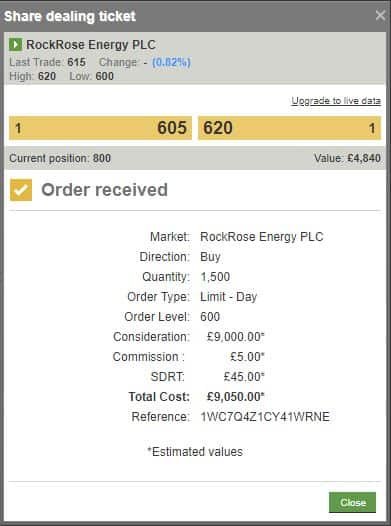

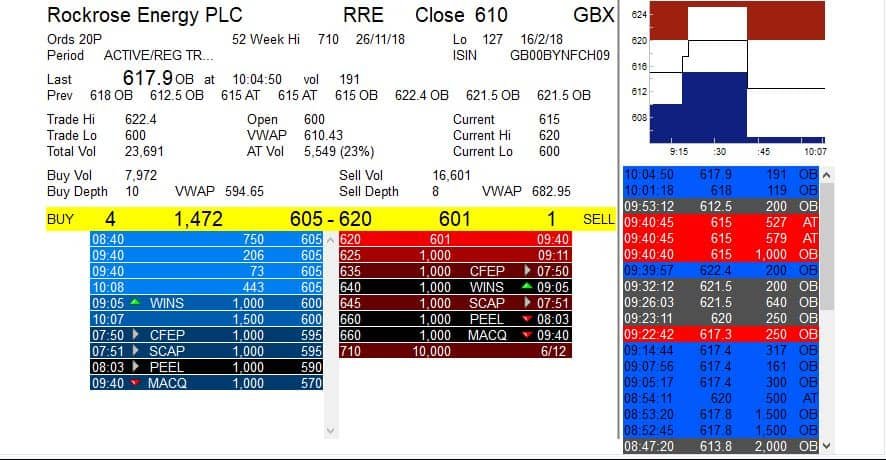

Our broker has confirmed that they have received our order. We should now be able to see our direct market access on the Level 2 window. Let’s take a look.

There we are – 1,500 shares on the left side to buy at a price of not more than 600p.

Should we change our mind or wish to edit our order, all we need to do is click the order in our broker and amend or delete as appropriate. Our order would then also be removed from the Level 2 window.

To make a direct market access sell and put our shares on the offer, the same process is required only we click sell.

Level 2 can be a great advantage in working better entries and exits in and out of stocks.

Where to get level 2 data

There are various Level 2 data providers in the UK, each with their own advantages and disadvantages. For a comprehensive review of the main providers, you can read my guide on the best Level 2 trading platform.

I use ShareScope Pro for my Level 2 data and would recommend ShareScope Pro for full-time traders. So if you want to get into Level 2 trading then you should check some out. I have also used its cheaper product SharePad Pro for my Level 2 requirements and would recommend this product too.

You can have a free trial of either product below.

Conclusion

We have seen how Level 2 trading can be useful and what advantages it offers traders.

However, we must be careful of information overload. It can be tempting to read too much into short term information, but Level 2 does have its uses in getting better entries and exits.

By understanding the market dynamics between Level 2 and the RSP, we can ensure that we won’t get caught out by market maker tricks such as tree shakes.