Short selling is a controversial topic. It is notoriously difficult, and this problem is worsened by the fact that there is so much conflicting information.

Most traders lose when trading leveraged products which are required to short stocks.

This article explains what the act of short selling is, how to short and where, and covers the risks and how to mitigate them.

What is short selling?

Short selling is when an investor borrows, then sells stock, and eventually buys the stock back at a cheaper price later on to return it to the lender at a profit. Short sellers are betting that the stock they borrow and sell will drop in price.

For example, imagine that I borrowed your mobile phone and sold it at the pawn shop for £100. Despite me selling it, I would still owe you the same mobile phone whenever you wished for it to be returned.

Fast forward a year, and your mobile phone manufacturer has churned out a new model en masse, and the price of your model has dropped 20% to £80. I decide to buy the mobile phone back, and return it to you – settling my obligation to give back what I had borrowed from you.

We can see how through selling and buying back at a lower price I have pocketed £20 despite never owning the asset (the mobile phone) in the first place.

Now, let’s say that the new model turned out to be a complete flop as reliability issues were a huge problem, and everyone believed that the penultimate model (your model) was vastly better. If this belief pushed the price to £150 I would still be obliged to return the mobile phone and so I would need to buy back what I had sold and return it – this time at a loss of £50.

What role does shorting play in the market?

Short selling and the short sale of stock is frowned upon by many long-term investors because they believe it destroys the market value of a stock. Shorting certainly has its dark sides – one would be naive to not at least consider it plausible that brokerage firms short sell stock in a company only to then offer to raise cash for the same company (at a discount) so they can close that position.

However, without shorters, there would be nothing to keep rampant bullish exuberance in check. Through short selling, there is at least an attempt at price equilibrium by market participants taking both sides of the trade. I believe it should be encouraged and it would be great for it to be more available than it is at the moment.

Many CEOs have condemned shorting for attempts at “destroying businesses”, but many shorters are not stupid – they know that shorting great businesses in the long term is not going to end well for them and so the focus tends to be on unprofitable and companies that cannot sustain themselves with their own cash flows, or companies that have clear problems. If shorters can hurt a CEO’s business – that’s because the business currently exists only to sell more shares and raise cash. It’s not yet a self-sustaining business model.

Why should you short?

Shorting, when done carefully and properly, can be very profitable and comes in very handy when stocks are falling.

In February and March 2020 when most stocks were falling and investors were seeing their accounts in freefall – my account was racking up P&L as I was heavily short stocks that were breaking down and collapsing.

Even for investors who held all of their stocks, they could’ve attempted to hedge the volatility in their P&L by opening up short positions on the major indices.

In the future, interest rates may possibly go up. When (and if!) this happens, money will likely flow out of equities into cash and bonds. Think about it: if cash and bonds become more attractive due to the interest rate increasing, then it’s only natural investors will be tempted and so stocks will need to adjust for that lowered risk premium.

At the end of the day, the risk-free rate determines how attractive other asset classes are, and when rates begin to rise it’s worth keeping an eye out for potential short candidates.

How do you short?

Shorting can be done through leveraged products such as spread bets and CFD trading. These mimick the underlying asset and the asset’s price, for example a stock’s price rising and falling.

To do this you will need to open an account with a provider who offers these products.

This article covers the process of shorting and the risks of shorting, but to do so you will need to use a spread bet account. You can read my guide on how to spread bet.

Shorting requires a margin account to trade on the stock market. Leveraged products charge interest fees.

Where do you short?

I use IG Markets for almost all of my execution-only trading and shorting transactions. It is the largest spread bet provider in the UK and offers the most liquidity across UK stocks.

Spread betting is tax-free and as well as short you can go long too (purchase of stock).

What is a short squeeze?

A short squeeze is when the price rises sharply due to shorters covering positions through the purchase of stock, and other market participants buying stock in order to force the price up.

Being short squeezed in a risk of shorting, which we’ll now look at in more detail.

What are the risks of shorting?

There are various risks of shorting which we’ll cover in this section:

- Risk of loss (potentially unlimited losses)

- Shorting overvalued stocks

- Takeover risk

- Being short squeezed

Potentially unlimited losses

Hypothetically, losses are infinite, because there is no limited upside to which a share price can reach. When we go long of an instrument – our downside is always 100% (unless leveraged then it is 100% of the exposure you have to the instrument).

As a retail investor (unless you self-cerfify as a professional) then you are protected by the new ESMA regulation where you are unable to lose more than 100% of what you have deposited (negative equity protection).

If you are a professional with a broker – this signs away your rights and you still can lose more than you have invested.

He who sells what isn’t his’n, must buy it back or go to pris’n

Daniel Drew

Professional clients must constantly be aware of the exposure they have as they are on the hook for any losses.

One bad trade can lead to financial ruin.

Shorting overvalued stocks

When looking for stocks to short, many investors look to find businesses they feel are overvalued and where plenty of success is already priced into the shares. This is dangerous for several reasons:

- Investors are optimistic, and so they are inherently bullish – this means one is fighting the trend when shorting

- Expensive stocks, in hindsight, can often appear cheap as their growth continues and premium valuation becomes justified

It’s not enough to simply find an expensive stock. Greed can take a long time to form and reach a crescendo. If shorting stocks (and trading in general) was easy, then everyone would be doing it. Finding short positions requires just as much research (if not more) than finding a long position, and the appropriate due diligence must be done. Of course, if the trade is purely short term and will be closed intra-day, then a price action trade requires no knowledge of the underlying equity – not even what the business does. But one should exercise caution when shorting and do the hard yards.

Takeover risk

When a company continues to fall, others in the sector can start to sniff a bargain. The competitor can view the company with envious eyes and is willing to pay over the market price in order to take the best bits of the company and get rid of the rest.

This is why shorting stocks at the beginning of the move is a lot less risk than shorting closer to the end of the move. You never know when a takeover bid is going to come – it could be announced midday or overnight and then the stock gaps up the next morning.

When shorting, illiquid small caps, one absolutely must exercise caution. It has happened that takeover offers have come in at a 100%+ premium to the last closing price.

In May 2019, this happened to WYG:

Tetra Tech proposed an offer for 55 pence in cash per share for WYG, which was a 244% premium to the closing price of the last trading day (current market price). Any shorters in WYG found themselves severely burned.

Short squeeze risk

Being squeezed is not fun. This happened to me when I took a short position ahead of Versarien’s (VRS) results. The stock immediately dumped 20% in the opening minutes and I prudently banked half of my position to derisk the trade and then intended to run my winner. That wasn’t to be however, as punters began lapping up the stock and bidding it higher.

I tried to close my position online via my broker and I couldn’t close it – meanwhile the price continued to tick up and up! Eventually, I called up and asked for a market buy to close my position at market, and this ended up overshooting my actual entry price.

I’d gone from flat, to 20% up, to being in the red in the space of about fifteen minutes! I generally tend to close out my shorts when the liquidity is there, and when I fade spikes I’m always quick to close these. Volatility in stocks that are shorted can be very high.

How to find stocks to short

I use SharePad to find stocks to short sell. This is done on my volume filter (available in the library).

Type in my name and you’ll see all of my filters pre-loaded for you to install.

Using the volume filter shows stocks that have had unusually high trading volumes in that session compared to an average of the previous 40 sessions.

Value traps

Rather than expensive stocks, we should look for ‘value traps’ – these are stocks that appear cheap on the surface but are actually expensive when we dive beneath it.

Stocks with falling earnings can often be value traps. The reason for this is because when using the PE ratio, we are taking the price and dividing this by the earnings per share.

To give an example, we have been following a stock, Beta plc, and it currently has a stock price of 10p.

Last year, its full year earnings were 2p. This puts the stock on a PE ratio of 5 (10p price/2p earnings).

However, the stock has just released half year earnings of 0.5p, and issued guidance on the full year of 1p – half the previous year.

Once this news is in the market, the new PE changes. The stock price is 10p but full year earnings are expected to be 1p – assuming the company doesn’t fail to meet them! The PE ratio is now 10 (10p price/1p earnings) and has now doubled.

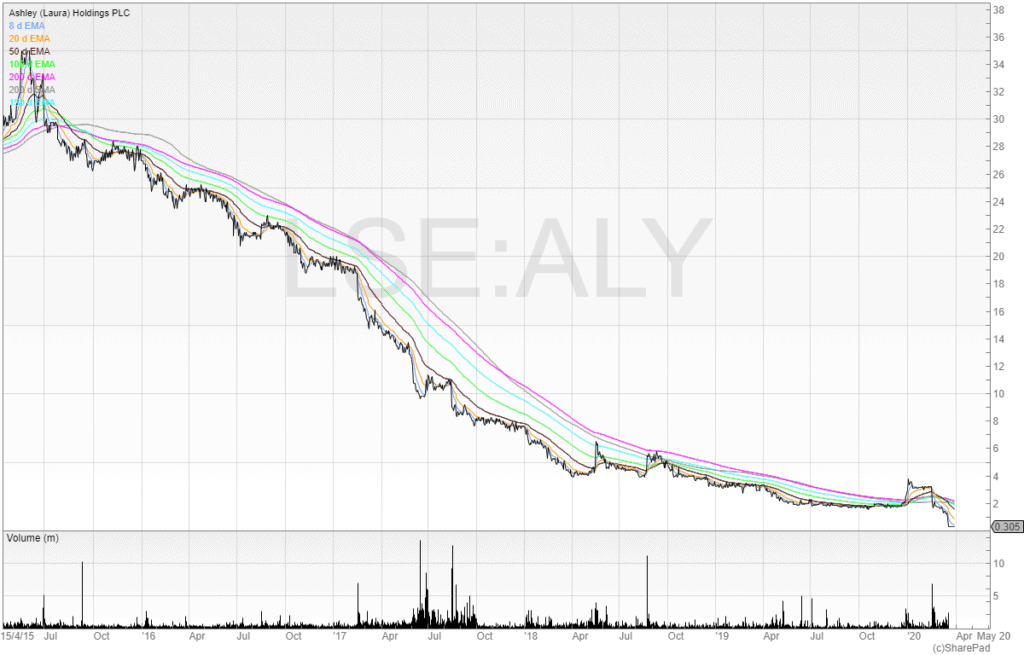

Does the market want to pay 10x earnings when it was previously valued at 5x when the earnings have now fallen? If the market is efficient, then usually not is the answer, and so the stock must re-rate to the new PE. This is a value trap and when shorting these are great stocks to identify. They are usually in a stage 4 downtrend and easily identifiable on the chart.

Here is an example of a classic value trap:

Aside from any short-term price rises, the broad trend has been one way: down.

Like breakouts, when shorting we are also shorting price breakouts, only to the downside. By shorting breakdowns we can just flip our breakout strategy upside down and use the same principles of risk management and trading the trend

Broken growth stories

Growth stocks provide plenty of bases and breakout opportunities for us to get long and capture a move. Stage 2 stocks are great to trade whilst the stock is uptrending, but when that growth starts to slow down the market no longer prices in such high growth prospects.

This means that the lofty PE valuations can start to deflate, bringing the shares down back to earth with a bang. Ideally, we want to be aware of potential breakdowns before they happen, so we can be ready for when the stock starts its move south.

Volumes signify change in trends

Big volumes show potential changes in trend, and you can scan for stocks with abnormal volumes with SharePad. It also pays to be aware of the market leaders because history has shown markets follow the leaders.

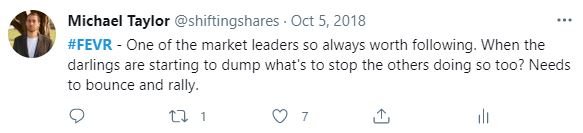

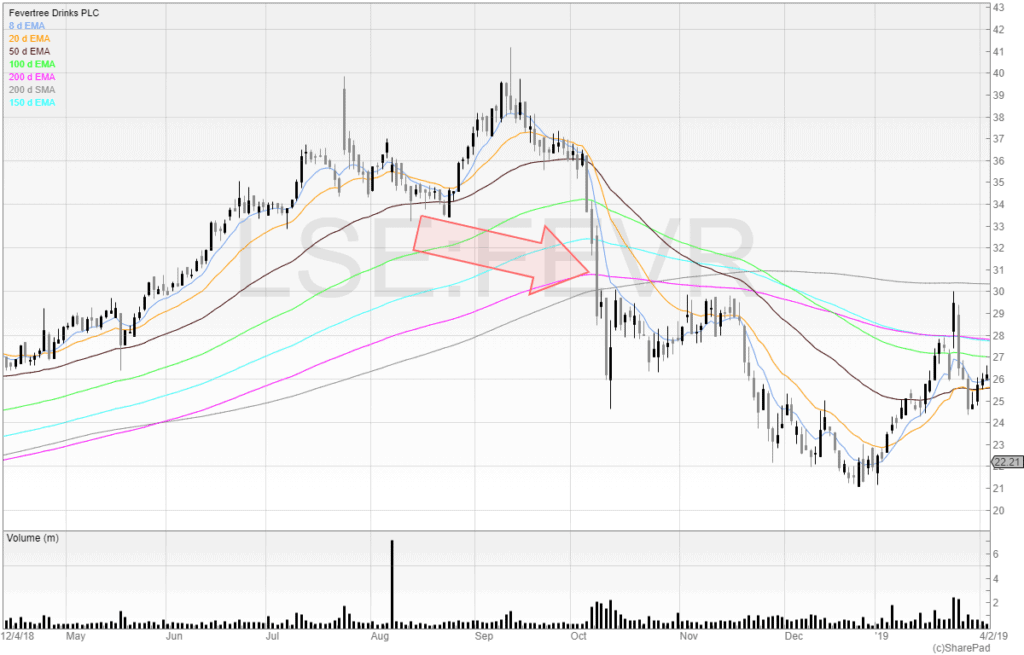

In October 2018, the 50 EMA was significant support for FeverTree (FEVR). The more a support level is tested, the more significant it becomes. The more significant the level then the higher the volatility that can be expected when it breaks through.

The market leader was on precarious support and I tweeted that if the stock started to dump the rest of the market would follow.

FEVR smashed through that support and experienced large volatility as short traders got on board and stop losses were cleaned out. By being aware of key levels in market leaders this can offer extremely generous risk/reward trades.

Another key level presented itself after the stock made its move from the 50 EMA – the 200 EMA.

Let’s take a look at the longer-term chart for FeverTree.

The stock had never ever traded below its 200 exponential moving average. This made it another key level as it would be a completely novel event for the stock. This offered another potentially lucrative risk/reward ratio trade.

If you missed the first trade, you could easily have profited from the second.

Conclusion

I prefer to use shorting to catch quick moves rather than extended periods of shorting. By capturing quick moves this not only can hedge long portfolios but shorting can also add profit to the portfolio in a market that may not be extremely bullish.

It’s much easier to go long and capture bullish trends, but markets are not always uptrending. A lot of the time they can trend sideways and even down, and a trader who can only trade long will struggle in a bearish market.

To finish off, here are a few things to be aware of:

- The risks – takeover risk, squeeze risk, the fact that the broker can withdraw the borrowed shares at any time and close you out

- Identify a candidate and pick a level – pre-plan the trade and don’t execute based on emotion

- Check your exposure – 1p = 100 shares when spread betting. If you’re betting £5 per point, that’s 500 shares. To calculate your exposure, it’s the amount of shares multiplied by share price.

Disclaimer: None of the material on this website is investment advice. No stocks mentioned are recommendations to buy or sell shares of a stock.

For this reason, Michael Taylor falls outside the scope of the Financial Conduct Authority.

Margin trading can result in losses and past performance is never a guarantee of future results.

For further reading, Mark Bentley has written about short selling including illegitimate short selling and stock lending on the ShareSoc website.