The bid-ask spread, also known as the bid-offer spread, is an often-overlooked cost of intraday trading (day trading). This article will help you get to grips with exactly what the bid-ask spread is and does.

What is the bid-ask spread?

Understanding the bid-ask spread is essential if you want to trade stocks consistently. It’s something every trader should be familiar with. Whenever you enter or exit a trade, the bid-ask spread will play a role.

Bid-ask spreads appear in most securities, as well as foreign exchange and commodities. Traders use the bid-ask spread as an indicator of market liquidity. High friction between the supply and demand for that security will create a wider spread.

We will now look at what a bid-ask spread is in more detail.

What is a bid and ask price?

When traders want to purchase a stock, they bid for it. And when they want to sell a stock, they ask for a bid. This is done by placing a buy or sell order at a certain price.

The bid essentially indicates the demand within the market, whereas the ask depicts the supply.

What is the bid-ask spread?

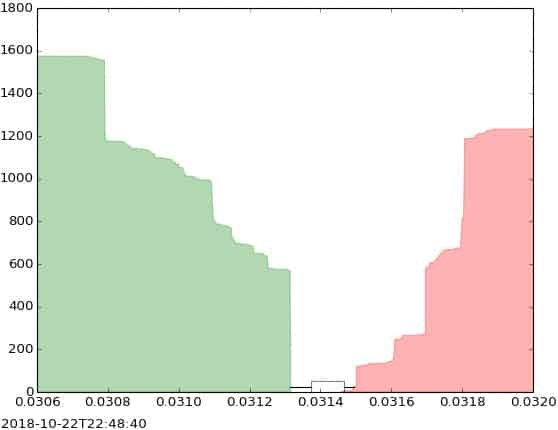

The bid-ask spread is the difference between the price that you can buy a stock for and the price that you can sell it for at any given time. When the bid-ask spread is wide, it’s a sign that liquidity is low. When the spread is narrow, it’s a sign that liquidity is high.

The ask price of a stock, index, commodity or cryptocurrency always exceeds the bid price.

For example, a stock that currently has a bid-ask of 1,000p/1,020, means that someone will buy buy the stock from you at 1,000p and someone selling the stock to you at 1,020p.

The market makers’ reward for providing liquidity to the market is the spread. However, you can use direct market orders in order to cross this spread at a better price.

For example, rather than paying the ask, you can use limit orders to place an order at the top of the bid and therefor be the highest bid price. This means you’re the most competitive bidder and you can buy the stock at a lower price if you’re filled.

If you’re looking to sell, then you can place an order to be the lowest ask price and aim to get lifted on the book. However, remember that other traders can alter their orders and you may not be the most competitive order for long!

Direct market access can be used on many an asset and is a great way of getting better execution.

How to calculate the bid-ask spread

Calculating the bid-ask spread is pretty simple: just subtract the bid from the ask. If you want to find out the spread percentage just use the following formula:

Bid-ask spread (%) = (Ask – Bid)/Ask x 100%

A narrow bid-ask spread can be useful for getting good entry and exit prices for your trades. And it can give you an idea as to the likely short-term direction of a stock.

Wide v thin markets

A wide market is one where there is a relatively large or wide spread between bid and offer prices. These types of markets are more commonly found where there is a lower amount of business activity. It is the opposite of a ‘thin’, ‘narrow’, or ‘close’ market.

In a thin market there is a small or tight spread between bid and offer prices. This is because there is lots of trading activity going on. Consequently, there are better opportunities to make a profit.

Market liquidity has a significant effect on spread. During times of high liquidity, an instrument’s spread is typically low. Because your trade can easily be matched, there is no need for high transaction costs.

Market makers’ greed keeps them in check also. When there are a lot of transactions, spreads decrease as market makers compete to get a piece of the action.

When trading activity declines, market makers are unwilling to deal and so the spread widens to reflect that.

This is why, if liquidity is low, spreads will often widen significantly due to the difficulty in pairing your trade with another trader in the market.

What exactly is stock market liquidity?

Stock market liquidity is an important concept for traders to understand. If you are familiar with what stocks are easiest to convert to cash without the price being affected, you will be in a stronger position to buy and sell.

Highly-liquid stocks can be particularly beneficial for day traders – their sizeable trading volume means that positions can be entered and exited quickly without price being hit. This is suited to the rapid pace of day trading.

When I trade stocks intraday I always want larger SETS stocks where I won’t affect the price with my buys and sells. You can see the market depth by looking at the highest price of the bid and lowest price of the ask then looking at the market prices and sizes below these.

Small-cap stocks tend to have wider a percentage spread, although the quoted spread can often be narrower. The real price to buy and sell is the effective spread, and you shouldn’t make an assumption that market maker spreads on Level 2 are the real spread.

Low liquidity leads to a high bid-ask spread

Trading less liquid stocks may take considerably longer to execute an order. This is because their share volume is so low. Low liquidity can also cause problems for smaller investors because it leads to a high bid-ask spread.

The average daily trading volume is a good measure of liquidity. As a general rule, frequent traders often lose money when liquidity is low. This is because the cost of crossing the spread is higher and the risk of not getting filled is lower.

However, academic research finds that low volatility stocks often generate higher returns over the long run than stocks with wider price swings, .

Stock Market liquidity v Forex liquidity

When assessing the difference between stock market liquidity and Forex or FX liquidity, there are a few important factors to consider. While all major currencies such as EUR/USD and EUR/JPY are highly liquid due to there always being a high volume of currency available to trade, exotic currencies such as USD/HUF and USD/TRY are traded much less.

The Forex market operates 24 hours a day with trading averaging $6.6 trillion per day, according to the Bank for International Settlements, which is many times that of the volume for stocks. This also means positions can be opened and closed round the clock, which is also helpful for liquidity.

If you’d rather not trade individual stocks, it may be worth considering trading the most liquid major stock indices such as the Dow Jones, S&P 500 and FTSE 100. Obviously, the Forex market represents the most liquid choice of all.

Who benefits from the bid-ask spread?

The bid-ask spread generally benefits the market makers. These large firms quote the bid and ask prices and then keep the spread as a profit. It’s the money they receive for efficiently and quickly matching up buyers with sellers.

If a buyer isn’t willing to pay a price beyond a certain threshold and sellers aren’t willing to lower their offer, spreads can widen dramatically. So, make sure you pay attention to the spread before you enter a trade.

What factors affect the bid price and ask price?

The aspects that influence spreads the most are liquidity, volatility and time.

Liquidity

Liquidity, also known as trading volume, refers to the number of shares available to buy and sell, as well as the number of shares that have been recently traded. Generally, the more liquidity in a stock, the tighter the bid-ask spread will be.

Volatility

Volatility refers to how much stock price moves in a given period. Volatile stocks generally have wider bid-ask spreads. This is because traders are less confident about the very short-term price movements.

Time

The busiest time is often around the market open and the close. During the middle of the day, stocks are normally much less liquid. This generally causes the bid-ask spread to be wider in the middle of the day compared to the open and close.

Other factors include catalysts, stock-related hype and stock. Stocks with a higher price generally have a wider spread.

Why the bid-ask spread is important for day traders

As a day trader, you need to be aware of costs including brokerage fees plus the entry and exit prices for trades. Keeping an eye on the bid-ask spread can potentially help you get better entry and exit prices and boost your trading profits.

The bid-ask spread also gives you an indication as to which way the stock price could likely move in the short term.

It’s also important to only trade stocks when there’s enough trading liquidity to get in and out of a position quickly. The bid-ask spread gives you some indication as to how much liquidity the market currently has.

When looking at the current market price, it’s always worth looking at the buy price and the sell price and the orders beneath and above these. To get a better entry, you can always set a buy limit order, as well as a stop order (stop loss/stop price).

Buy limit orders are best used on liquid assets as any small-cap stocks can see volatile share prices based on market makers moving their prices up and down.