The AIM trading market is attractive for new traders and investors. Many of the shares listed there are higher-risk but offer high rewards – with some stocks increasing in price ten-fold.

Some AIM winners include Boohoo and Fever-Tree – as well as household names such as ASOS.

However, the ratio of winners to losers is skewed towards the losers. AIM companies on the junior market typically have a smaller market capitalisation and it pays to have your wits about you when dealing with AIM stocks.

This article will cover ten tips you can use before buying a stock listed on the AIM All-share index.

10 AIM trading strategies and tips for 2021

- Check the chart

- Check the company’s balance sheet

- Check the company’s cash flow statement

- Check the company’s income statement

- Check the recent RNS announcements

- Head to AIM Rule 26

- Check director remuneration

- Check director shareholdings

- Check liquidity

- Check the bulletin boards

1. Check the chart

Before buying any stock I always like to check the chart. This tells me whether the stock is trending upwards, downwards, or sideways.

If a stock is trending downwards then I’ll often stop my research from going any further.

Why would I want to buy a stock where the share price is falling? Doing so would just be gambling that I’m printing the bottom.

I don’t gamble because I prefer to make money consistently.

Sometimes, I’ll take my research a bit further and see what the company does to get an overview and develop the story. That way, if something changes in future, I’ll be more up to date with the company.

Here’s an example of a company I typically avoid.

We can see that for years the price has been falling. There was a brief resurgence in early 2021 but that rally fizzled out and normal service resumed.

Here’s an example of a stock I bought but sold too early.

Notice how once the stock broke out the stock trended upwards? These are the stocks I want to buy.

Stocks that are trending upwards often continue to move upwards. AudioBoom rose over 200% in just 7 months.

Here was my call on Twitter:

Checking the chart is an absolute must when buying AIM shares.

It will save you a lot of time and money.

2. Check the company’s balance sheet

The company’s balance sheet tells us about the company’s financial health (assets and liabilities) at a specific point in time.

This is important to us for two reasons:

- AIM is a growth market

- Growth companies often require funding

I check the balance sheet because I want to see the company’s cash balances.

There’s no point buying a stock if the company is likely going to raise capital in the next few months.

It’s better to wait until after this has happened or take the placing.

Here’s an example of a company that clearly needed funding.

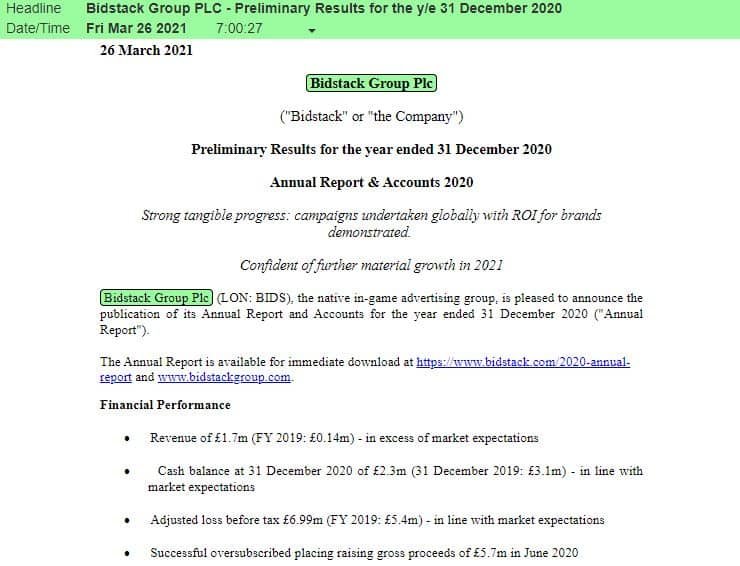

We don’t need to go to the balance sheet here as the company clearly states its cash balance at 31 December 2020 of £2.3m.

I knew this company and I knew it burned roughly £5 million plus per year.

That meant that the company would be raising money in the next few months.

Here’s the stock’s chart. I’ve marked an arrow the day the results were released.

We can see that the price fell from around 6p and continued falling over the coming months.

The placing was finally announced 1 July 2021 at a price of 2p. I took this placing and got a much better entry in the stock than 6p – plus I was buying when the uncertainty of a placing was removed.

However, I could’ve shorted the stock knowing a placing was coming, and then covered my position in the placing.

Here’s the balance sheet below.

We know that the company had just over £3 million in cash on 31 December 2019, and that it raised £5.7 million in June 2020.

Therefore, to be down to £2.3 million by December 2020 meant there was some serious cash burn.

It was clear a placing was coming and so this is why people sold in advance or held off from buying. Investors who wanted to take a position were far better off waiting for the placing as placings are almost always at a discount.

Those who didn’t check the balance sheet and bought in at 6p will no doubt be feeling sour.

Smaller companies are often easier to understand than larger companies, and it’s worth being wary of acquisitions as these can often complicate the numbers.

3. Check the company’s cash flow statement

The company’s cash flow statement tells us how cash moves throughout the business.

This is important to us because we can find out how much the company is spending and how much cash is leaving/coming into the business.

Here’s Distil’s cash flow statement.

We can see that in 2020 the company burned through £99,000 in cash in operating activities.

However, this was after movements in working capital. By moving up the cash flow statement we can see that before movements in working capital the company generated £246,000 in cash. But it’s the bottom line that counts!

We can see that in 2021 the company generated £254,000 in cash after movements in working capital.

This means that the company is not reliant on external funding to keep the company going.

But if the number was negative? Then we’d know how much the company was burning in the period specified.

For example, if the results are half-yearly results covering a six month period, and the company burned through £9 million in cash, then we know the company is spending £1.5 million per month roughly.

If the balance sheet says there is only £6 million in cash on the balance sheet – then it’s clear that from the point in time on the balance sheet there are only four months’ worth of cash left!

This is why checking the cash flow statement as well as the balance sheet gives us an accurate picture of the company’s financial position.

We calculate a company’s cash burn by taking the company’s burn rate and dividing it by the number of months.

4. Check the company’s income statement

The company’s income statement records the financial performance of the company.

It’s here that we see the company’s revenues and profits.

This is the top half of the income statement for Fevertree.

We can see that the company’s revenue fell in 2020 – not surprising given that the on-trade split of their revenue was heavily affected by the lockdowns. Retailers had a booming year during the lockdown but this was nowhere near enough to make up for lost revenue in pubs and bars.

The goal of checking the income statement is to quickly gauge how well the company is performing. Is revenue growing quickly or is it slowing down or even declining?

It’s also important to check the bottom half of the income statement.

This is where we see the bottom line – net profit. We can see that Fevertree created a total comprehensive income for the year of £42.1 million.

However, was this in line with market expectations? By checking the forecasts we can see if the company is performing better than expected, in line, or worse than expected.

You can check the company’s forecasts on SharePad (risk-free trial worth £69) or by emailing the company’s PR agency.

Here are the broker forecasts for Fevertree.

We can see that the forecasts for Fevertree are all for the company to continue growing.

I like to look at turnover, EDIT, and post-tax profit. Dividend yield is not so interesting for me as I am looking for capital growth.

These forecasts give us an idea of where the company is in the narrative cycle.

Stock market winners usually have a strong narrative. Any increase in growth can boost the share price heavily. The best AIM shares typically trade on a higher rating.

This is because analysts are usually behind the curve. They’re scared to make bold claims so instead temper down their forecasts and stay in one group.

If you’re going to be wrong – it makes sense to be wrong along with everyone else.

5. Check the recent RNS announcements

Checking a company’s recent RNS announcements helps to build a picture of the stock and get its story.

Here we can see a list of Xaar’s RNS announcements from the past year.

We can quickly check trading updates, interim and full year results, as well as holdings RNSs to see how the share register has changed throughout the year.

I like to skim the commentary on earnings updates and see how the narrative changes.

This picture is from SharePad – I have used my “Garbage filter” to remove unwanted RNSs such as Total Voting Rights and Price Monitoring Extensions.

For a full walkthrough of how to implement my filter or your own custom filter you can read my RNS tutorial.

Once we have a good understanding of the story so far we can start digging deeper into the stock.

6. Head to AIM Rule 26

AIM Rule 26 contains a lot of information relevant for us – in particular the significant shareholders (read my full walkthrough tutorial on AIM Rule 26 here).

All companies listed on AIM are required to have a section on their website which covers all the points necessary for display in AIM Rule 26.

Here is Escape Hunt’s section for AIM Rule 26 on its website.

AIM Rule 26 is ideal for finding any other exchanges the stock trades on and also the full number of shares with outstanding warrants, options, and other securities in the stock.

Knowing the market cap and potential fully diluted market cap can help to assess the risk/reward in the business.

For example, if management intends to award itself a third of the company at a price 20% higher than the current price with nil-cost options, then this changes the upside dramatically.

It also contains biographies of management teams, and a list of the company’s advisers, nomads, and accountants.

Once we’ve checked out AIM Rule 26, it’s time to check what the directors earn and take from the company.

7. Check director remuneration

It’s always worth checking what directors pay themselves.

If the directors pay themselves increasingly more each year yet the stock price only goes down – is this a company you want to invest one?

You can find director remuneration in the Annual Report. This can be downloaded from the company’s website.

Here’s the 2019 remuneration report for a company called Time Out.

We can also see the previous year’s remuneration too.

The chief executive has paid himself £840,000 in 2019 and £420,000 in 2018.

Here’s the stock price chart for 2019 and 2018.

Shareholders who held on over the period were down, and at one point they were over 50% down on their shareholdings.

But at least the directors got their bonuses.

8. Check director shareholdings

Another clue as to how the directors see themselves can be shown in the director shareholdings.

This again can come from the Annual Report and is available on AIM Rule 26.

Directors who own lots of stock will see themselves more as owners of the company. Directors who own zero stock are just highly paid employees.

PRO TIP (GREY BOX): Check where the directors’ interests come from. Did they buy shares with their own money? Or was it granted in the form of nil-cost options?

At the end of the day, it’s much better to have directors who are aligned with your interests as they have skin in the game, rather than directors who couldn’t care less about shareholders.

9. Check liquidity

One of the final steps is to check for liquidity. It’s no good buying a stock for a trade if there are barely any trades and there is no volume.

You can do this by checking the trades of the stock.

Here’s a list of trades for Phoenix Copper.

You can scroll back on previous days and see all of the trades that day too.

If you don’t have SharePad, you can use the London Stock Exchange’s official website.

10. Check the bulletin boards

Finally, I always think it’s a good idea to check out the bulletin boards. Bulletin boards are mainly full of anonymous monikers all pushing their own agenda.

There are sometimes incredibly well-researched posters but these are often drowned out by multi-ID spammers, hence why I believe they’re a waste of time. These boards are also not moderated or regulated by anyone – not by the bulletin board owners of the Financial Conduct Authority (FCA).

However, bulletin boards can give you a glimpse of the sentiment of a stock. If there is only one post every few weeks – you know that sentiment for the stock is rock bottom.

But if the bulletin boards are seeing several posts a day (sometimes the hot stocks can reach hundreds of posts a day) then you know there is interest in the stock. Generally, the more posts, the higher the interest.

Conclusion

We’ve looked at ten different things to check before buying an AIM share for AIM investors and traders.

The Alternative Investment Market is full of early stage businesses which differs from the Main Market. Protecting yourself by following some (or all) of these rules will save you money.

For those who want to learn more about trading the UK stock market – you can learn about my online trading course here.

None of the stocks mentioned in this article are recommendations to buy – they are used for example purposes.