The Alternative Investment Market (AIM) is a junior growth market on the London Stock Exchange. The problem is that the AIM is full of hazards. The lack of enforced regulation means AIM can swindle investors with little recourse available.

Shares listed on AIM are popular because of their lottery ticket factor and high volatility, but an understanding of these stocks is necessary before you invest or trade AIM stocks. This article will explain the Alternative Investment Market and how to begin AIM trading.

What is AIM trading?

AIM trading refers to the trading of shares on the Alternative Investment Market on the London Stock Exchange. AIM shares can be speculative in nature due to lower regulation that the market offers. For this reason, many private investors are attracted to stocks that are listed on the AIM.

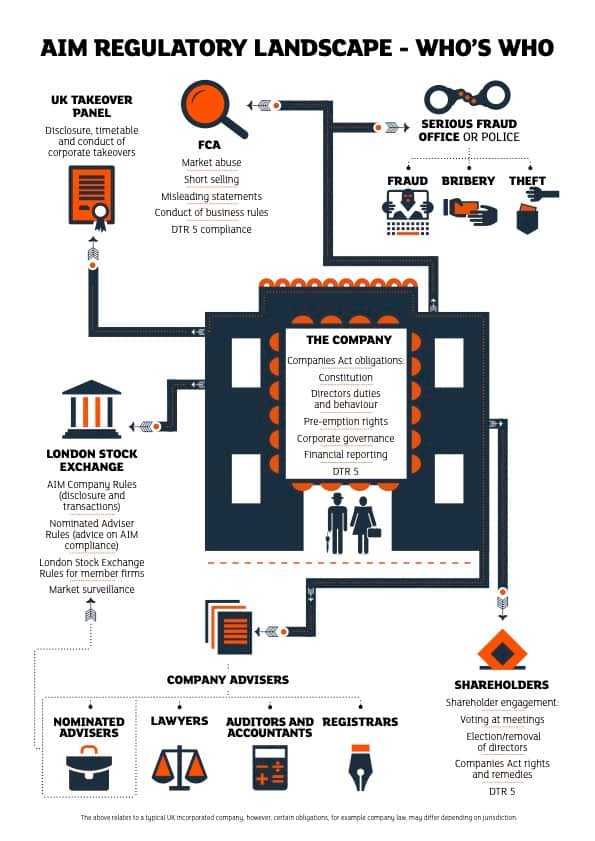

Who regulates the AIM market?

The AIM is regulated by several people and organisations. It is complex because there are various parties with different responsibilities.

The infographic below outlines the AIM regulatory landscape.

In particular, we’ll look at:

- The Nominated Adviser

- The accountants and auditors

- The FCA

Nominated Advisers

The Nominated Adviser (commonly referred to as the Nomad) is responsible for ensuring the company follows the rules. The Nomad is paid by the company however, so there is a conflict of interest because the Nomad is incentivised to see the company keep its listing so that it can continue to have its retainer paid.

The Nomad may also be the company’s broker which is responsible for raising funds for the company. Within the broker itself, there may be a corporate finance team as well as a research team.

These teams must be separated by a Chinese wall by law so that the research team is not actively promoting the stock through research whilst an equity fundraise is ongoing.

But in the Wild West of the Alternative Investment Market, one should treat these Chinese walls with a healthy dose of salt.

Auditors and accountants

The company also pays the auditors and accountants. Therefore, there is clearly an incentive for the auditors and accountants to not be as stringent as they should be in their dealings with the company.

In 2014 they revealed it that Tesco had overstated its first-half profits by over £250 million because of booking payments from suppliers earlier than it should have done.

The auditor, PwC (PricewaterhouseCoopers), had been auditing Tesco’s accounts for 32 years. How independent could they have been?

Fast forward seven years later to 2021, and Grant Thornton is being sued for £200 million by liquidation firm FRP Advisory claiming that the auditor was negligent regarding Patisserie Valerie’s financial statements.

The Financial Conduct Authority

The Financial Conduct Authority (FCA) is also responsible for market abuse and insider dealing.

However, the Financial Conduct Authority has been about as effective as a single cell amoeba. Nobody has been prosecuted for insider dealing (despite regular clear breaches of insider selling) in the last five years.

When it comes to regulation on AIM, there is little regulation and this regulation is poorly enforced.

What companies list on AIM?

Companies that list on AIM are typically growth companies. These are companies that want to access capital in order to grow and develop the business models. These companies are smaller (though not always) and less-developed than more mature companies.

Listing on AIM is attractive for companies because there are fewer rules and regulations. This can be good for companies but bad for private investors and traders.

Should you trade AIM shares?

AIM shares can be highly profitable to trade because of the volatility they can offer. But volatility is a double-edged sword, and share prices can fall as fast as they can rise. For those who are looking for capital growth then AIM shares can present plenty of opportunities due to their smaller size.

Advantages

- Higher volatility – stocks can move up and down fast due to illiquidity and small size

- Inefficient market – many stocks are under-researched and therefore can benefit from quick price appreciation when the market re-rates the stock to a fairer value

- AIM offers investors the opportunity to invest in businesses when they are small – ASOS, Dominos, and many other famous brands started their journeys on AIM

Disadvantages

- Poorly regulated – the existing regulation is poorly enforced and it is unlikely you will see your money back if you are scammed

- Market makers – many AIM shares are traded through market makers on the London Stock Exchange’s SETSqx platform rather than its flagship SETS platform for electronically matched dealing

- Most companies that list on AIM lose value – therefore the odds are stacked against you unless you know what you’re doing

Where to find AIM shares

AIM shares are listed on the London Stock Exchange. You can find them by using SharePad.

Understanding AIM data

Data on AIM is relatively limited. The laissez-faire attitude towards regulation (or lack of it by the Financial Conduct Authority) sees many companies list with business ideas rather than actual businesses.

In 2007, SEC commissioner Roel Campos caused an upset when he responded to a Dow Jones report saying that 30% of companies were gone in a year: “That [AIM] feels like a casino to me, and I believe that investors will treat it as such”.

Mr Campos may have a point, however it must be noted that it is an awful shame that he didn’t feel that there was any sense of a casino when he decided to lift leverage limits on the investment banks to 33:1 which allowed them to speculate more with collateralised debt obligations (CDOs).

This speculation ultimately caused the 2008 Great Financial Crisis. This happened in 2004, and within a decade none of the five investment banks would exist in their original forms. Thanks Roel!

When it comes to AIM, one study by two London Business School professors highlighted that in the first 20 years of AIM, investors would have lost money in 72% of these.

Further, out of the 2,877 companies studied, investors would have lost at least 95% of their investment at least 30% of the time.

In the same study, there was just 1.4% of companies that delivered multi-year returns above 1,000%.

AIM is clearly high risk and high reward. Pick the right stock and you could see a huge windfall. But pick the wrong stock – and stick with it – and you will watch your money circle the toilet bowl and be flushed away.

AIM Index

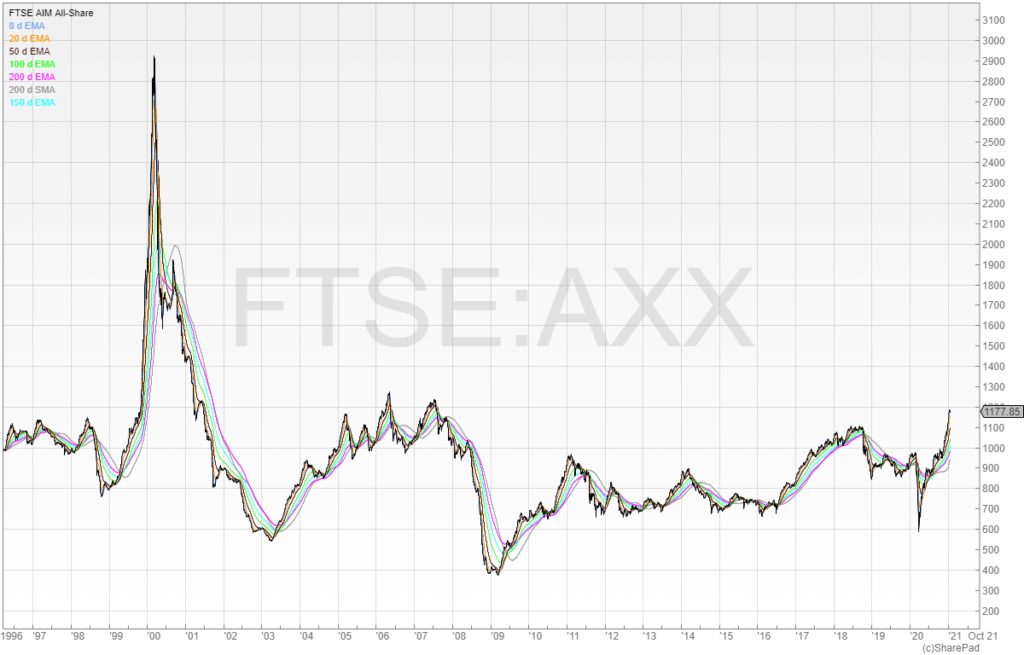

Below is a chart from the FTSE AIM All-Share. This is the index that includes all AIM listed shares.

We can see that there was a spike around 2000 in the Dotcom boom and ever since then AIM has struggled to gain any traction. There have been winners, but the index is dragged down by an abundance of losers.

How to trade AIM stocks

Trading AIM stocks is the same as trading Main Market stocks or any other stock listed on the London Stock Exchange.

However, there are a few differences between Main Market stocks and AIM listed shares.

Levels of shares to be in public hands

First of all, on AIM there is no prescribed level of shares to be in public hands. This means companies can list with only a tiny amount of shares available to buy for the secondary market.

This is in contrast to the Main Market which is 25% of shares to be in public hands.

Trading record

AIM doesn’t require a trading record for a listing, which means any idea that can raise money can list.

The Main Market requires a trading record of three years before the company can apply for a listing.

Shareholder approval for transactions

Shareholder approval is not required for most transactions for companies listed on AIM. This means that management can decide to acquire businesses that are in their own interest and not the company’s if they so wish.

This happened when the directors of Management Resource Solutions acquired a drone company for £1.4 million in company stock that had net assets of £1 and no operations. Shareholders fought back and the company spent all of its money fighting its own shareholders. As a result, the company went bust and delisted, and everyone lost their money.

The Main Market transactions require shareholder approval.

Market cap limitations

The final difference is the market cap where on AIM there is no minimum market cap required.

The Main Market has a minimum market cap.

Conclusion

The AIM market is akin to the Wild West. Fortunes can be made and lost, but for the investor willing to dig and get their hands dirty then they have a chance of finding gold. This part of the London Stock Exchange is often neglected by institutions which results in both illiquid and inefficient pricing.

If you’re looking to find the next ASOS or Domino’s, then AIM is where you should look.

Due to the illiquidity of AIM shares they are attractive for traders as volatility can be high. But volatility works both ways and all traders should be careful to not put in what they cannot afford to lose.

For further reading, you can read my cover article in Investor’s Chronicle.