Choosing your stock broker in the UK can be a daunting task. There are many stock brokers to choose from and a lot of information out there.

This is further compounded by confusing jargon and the lack of information from someone who has experienced the same problem.

This article looks at the best online stock brokers in the UK as well as the most popular and will evaluate the strengths and weaknesses of all of them.

Below is an overview of the UK online stock brokers covered in this article…

Best online stock broker UK in 2022 (at a glance)

- IG Group (Best all-round stock broker)

- Hargreaves Lansdown (Best stock broker for part-time traders)

- Spreadex

- Degiro

- eToro

- Freetrade

- Trading212

IG Group

Best all-around stock broker

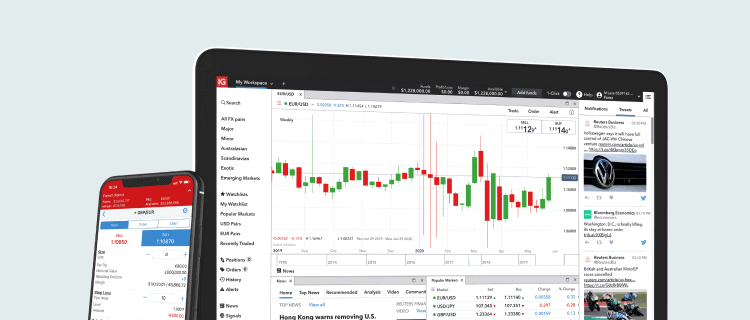

I’ve awarded IG Group the best all-round stock broker in the UK because of the versatility of IG and most of my execution dealing is done with the company.

IG is also one of the cheapest brokers around and offers share dealing for £8 which can even drop to £3 for regular dealers.

IG has an excellent mobile app, and it comes with charting and technical analysis features. IG’s support is also of high quality.

They were founded in 1974 by Stuart Wheeler as a spread betting business. For more on spread betting you can read my guide here. In September 2014 the company began offering stockbroking services.

IG is the market leader in the UK and many other countries. It is also listed on the London Stock Exchange as IG Group plc with the EPIC code IGG and has traded publicly since July 2000.

This is an advantage because the company has been around a long time and also its accounts are subject to higher scrutiny as a listed company.

Another big advantage of IG is that it offers Direct Market Access. This gives us the opportunity to become a market maker and provide liquidity at a certain price and in a certain size.

This can give us better prices on our dealing and allow us to decide where we want to deal in the market – an advantage not offered by any other broker in the UK market.

Read my IG review for a detailed review of their platform and everything else.

| ISA | Yes |

| Direct Market Access (DMA) | Yes |

| UK share dealing commission | £8* |

| US share dealing commission | £0 |

| Phone dealing | Yes |

| Other charges | Yes** |

| Free transfer | Yes |

| Mobile trading app | Yes |

**There is a £24 quarterly custody fee which only applies if you deal two times or less in a quarter.

Pros of IG Group

- Offers ISA along with some of the lowest cost commissions in the UK

- No extra charges to transfer an ISA to IG and only a £24 per custody fee for those that deal two times or less in a quarter

- Offers DMA capability which gives us a huge versatility in order selection

- Top-rate mobile app

- Charting and technical analysis suite available

- Free demo account available

Cons of IG Group

- No limit or fill or kill capability on SETSqx although one can call to trade

- Minimum deposit of £250 will put some people off

Hargreaves Lansdown

Best broker for part-time traders

I’ve awarded Hargreaves Lansdown the best broker for part-time traders award because they allow the option to set limit orders and fill or kill orders on SETSqx stocks.

For part-time traders who can’t be at their screens all the time, this can be useful because orders can be placed outside of market hours and left to work in the market.

The company was founded in 1981 by Peter Hargreaves and Stephen Lansdown, and like IG they’re also a constituent of the London Stock Exchange.

Hargreaves Lansdown trades with the EPIC HL., and again we have greater transparency over the accounts.

| ISA | Yes |

| Direct Market Access (DMA) | No |

| UK share dealing commission | £11.95* |

| US share dealing commission | £11.95 |

| Phone dealing | Yes |

| Other charges | Yes** |

| Free transfer | Yes |

| Mobile trading app | Yes |

**There is a 0.45% annual holding charge on the first £250,000 held in the ISA account, falling to 0.25% on the value between £250,000-£1m falling again 0.1% between £1m-2m, and no charge for above £2m.

Pros of Hargreaves Lansdown

- Allows limit and fill or kill orders on SETSqx stocks which can be useful for part-time traders or those who can’t be at the screens all day

- Reputable and long-standing broker which is stock market listed (FTSE 100)

- Free online trading for unit trusts and open-ended investment company funds

Cons of Hargreaves Lansdown

- Trading fees are significant for smaller trade sizes (IG better in this respect)

- Expensive holding charge begins to add up increasingly as the portfolio grows

Spreadex

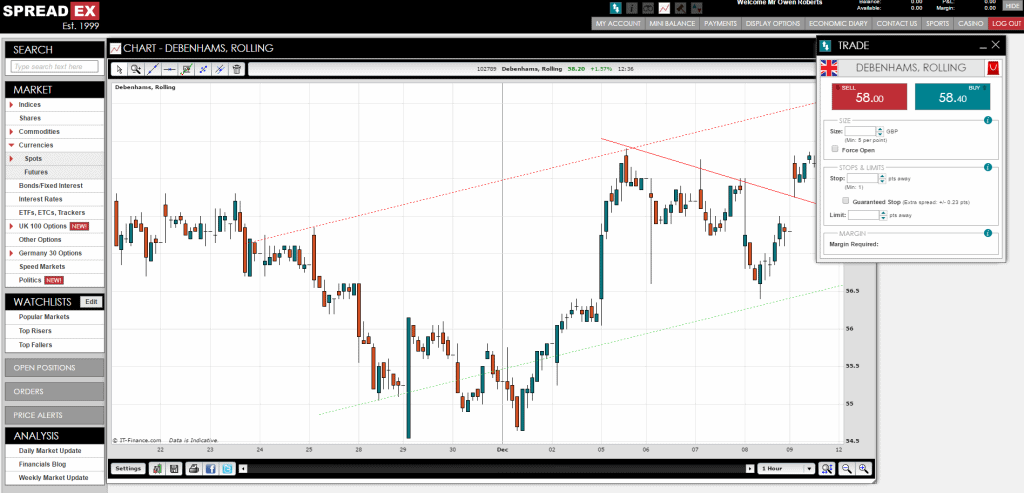

Spreadex isn’t a stockbroker but a spread bet provider where you can buy and sell shares (read my full guide on spread betting).

I have included Spreadex in this list as they are a common platform for buying and selling stocks despite this being through spread betting which is a leveraged product.

Spreadex is a spread betting broker founded in 1999 by Jonathan Hufford.

| ISA | No |

| Direct Market Access (DMA) | No |

| UK share dealing commission | Free (but overnight funding applies) |

| US share dealing commission | Free (but overnight funding applies) |

| Phone dealing | Yes |

| Other charges | No |

| Free transfer | Yes |

| Mobile trading app | Yes |

Pros of Spreadex

- There is no ISA capability but all profits from spread betting are tax-free

- Excellent phone support and service

- Spreadex has a useful and reliable app

- Spread betting is commission-free

Cons of Spreadex

- There are overnight charges for holding spread bets

- Most leveraged traders lose money

Degiro

Degiro is an Amsterdam based online brokerage that offers low-cost fees. It was founded in 2013 and offers a wide range of markets to trade.

Although Degiro’s fees are cheap, I believe they are only suitable for those with accounts less than £1,000 and those who are buying liquid FTSE 100 stocks.

Here is how DeGiro shows their fees:

If we take into account only the fees, then it is undeniable that DeGiro is the cheapest out of the competitors listed.

However, we also need to take into account execution…

When I was a Degiro client, they did not work to get prices inside the bid-ask spread in 2016. They saved on this fee and passed the savings onto the client.

Whilst this is not an issue if we are buying FTSE 100 stocks, where the spreads are so narrow anyway, it does become a problem if we are buying stocks with wider spreads.

The more shares we are buying, the more the execution price matters, and very quickly it becomes worth paying more for a broker who will deal for you inside the spread and pay a higher commission.

For example, if we are buying 1,000 shares in a stock with a spread of 100p-106p, and because Degiro doesn’t deal inside the spread we will pay 106p for this. The total we pay is £1,060 plus commission.

It is unclear exactly how DeGiro’s commission fees work looking at the above, but let’s assume we pay 0p in commission and the trade is free of charge.

If we try to execute the trade on another broker, and they can get us 105p for 1,000 shares, we only pay £1,050. If the dealing fee is less than £10 then we are better off using the second broker.

This problem becomes worse the more shares we buy.

I once bought £500 worth of shares in a stock that had a 20% spread when I was starting out. My £500 instantly became £400 because Degiro didn’t deal inside the spread.

Degiro also does not offer UK residents an ISA account, and so for that reason alone, I would avoid it.

| ISA | No |

| Direct Market Access (DMA) | No |

| UK share dealing commission | £1.75 + 0.014% |

| US share dealing commission | €0.50 + $.004 per share |

| Phone dealing | Yes |

| Other charges | Yes* |

| Free transfer | N/A |

| Mobile trading app | Yes |

Pros of Degiro

- If you’re buying small amounts (<£1,000) of FTSE 100 shares then Degiro is the cheapest broker

Cons of Degiro

- No ISA which means Capital Gains Tax on all profits over £12,300

- No dealing inside the spread which means terrible execution prices

- The more money you have with Degiro the more negatively this affects you

eToro

eToro is a “social trading” broker that markets itself as being “commission-free”.

In my opinion, this is misleading because whilst they are correct that clients do not pay any form of commission, all of the positions eToro’s clients take are in the form of a CFD where overnight interest charges apply. CFDs are also subject to Capital Gains Tax.

eToro’s spreads are relatively thin, however, the broker does not offer a wide range of UK stocks. eToro also does not have direct market access.

The broker has a “CopyTrading” feature whereby the eToro trading platform allows clients to follow other clients and anyone following another will see the leader’s traders mirrored on their own accounts.

This appears to be the main sell of the broker as eToro runs a Popular Investor program, where Popular Investors who rise through the ranks can earn fixed income payments based on the minimum average equity of accounts following them and a minimum level of AUM (assets under management).

| ISA | No |

| Direct Market Access (DMA) | No |

| UK share dealing commission | Free but overnight funding applies |

| US share dealing commission | Free but overnight funding applies |

| Phone dealing | No |

| Other charges | Yes* |

| Free transfer | Yes |

| Mobile trading app | Yes |

Pros of eToro

- Ability to ‘copy’ other investors (personally I don’t see this as a pro but it’s eToro’s USP)

- No commission on trades but overnight funding fees are paid daily (which can quickly become more expensive than commission)

Cons of eToro

- No ISA and all trades are done via a CFD which means profits are taxable

- Lack of UK stocks

- No direct market access

Freetrade

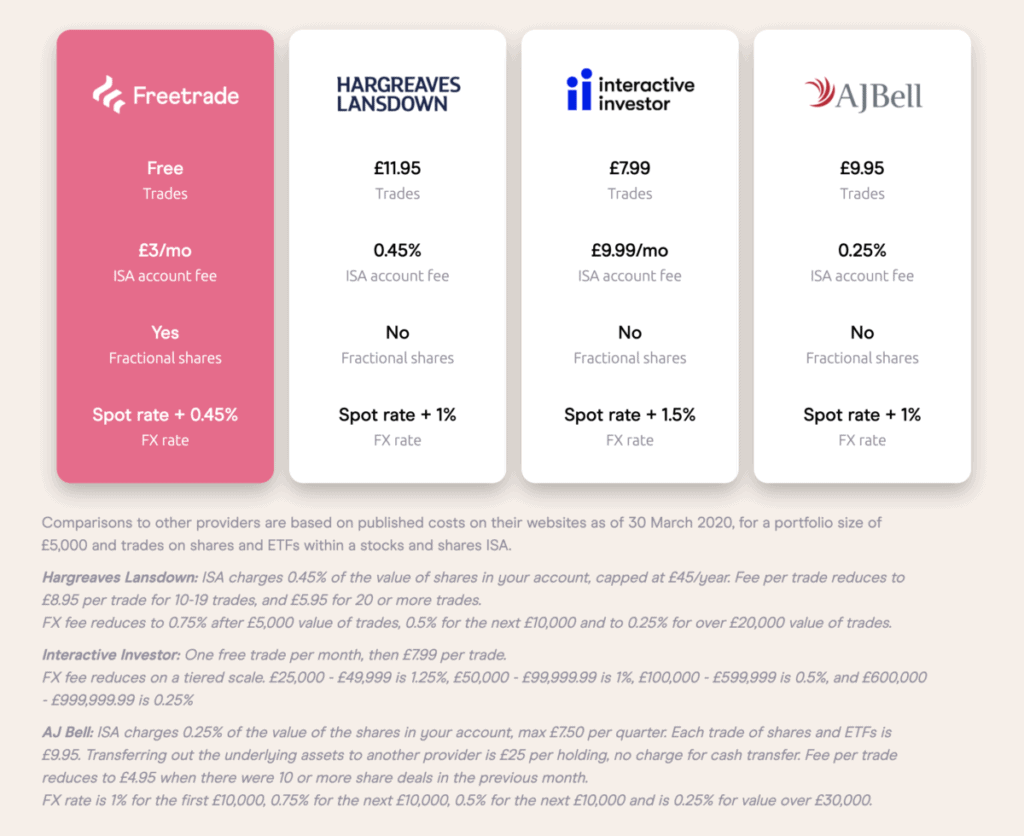

Freetrade was founded in 2015 and is a commission-free UK stockbroker which offers an ISA for the flat fee charge of £3 per month.

The company used to offer commission-free trades which only executed at the end of the day. This was silly because the price could change by so much at the end of the day it might’ve been better to just pay commission and sell.

However, Freetrade now offers free instant execution trades but the downside is its list of stocks is small as only the FTSE 350 companies are available in this.

Freetrade offers “Freetrade plus” which provides more stocks and other features for £9.99 per month.

This means that you are paying £119.88 a year just to access stocks that brokers like IG Group and Hargreaves Lansdown offer freely.

| ISA | Yes |

| Direct Market Access (DMA) | No |

| UK share dealing commission | £0 |

| US share dealing commission | £0 |

| Phone dealing | No |

| Other charges | Yes* |

| Free transfer | Yes |

| Mobile trading app | Yes |

Pros of Freetrade

- Instant free execution but this is limited to a small number of UK stocks

Cons of Freetrade

- Freetrade plus is £9.99 to access more stocks

- £3 per month to hold an ISA with Freetrade

- No direct market access

Trading 212

Trading 212 is a London based fintech company that allows users to trade equities, forex, and commodities.

They claim to be the first zero-commission stock trading service in the UK although IG Group also offers zero commissions now for longer-term clients. Trading 212’s free trades are instant and unlimited.

Trading 212 offers both ISA capability as well as CFD accounts.

The company also allows the purchasing of “fractional shares” which is a fraction of a share. It is not possible to buy or sell fractional shares on an exchange, therefore, as there is no transfer or delivery of the stock that is being dealt in it makes Trading 212 a bucket shop.

There is nothing wrong with this as Trading 212 is regulated and authorised by the Financial Conduct Authority but my personal opinion is that if you can’t afford a share then you shouldn’t be buying it.

| ISA | Yes |

| Direct Market Access (DMA) | No |

| UK share dealing commission | £0 |

| US share dealing commission | £0 |

| Phone dealing | No |

| Other charges | No |

| Free transfer | Yes |

| Mobile trading app | Yes |

Pros of Trading 212

- £0 commission investing

- Unlimited instant trades

- No ISA fee or administration charges

Cons of Trading 212

- No direct market access

Choosing your UK online stock broker

There are a lot of brokerages in the UK. Many of the brokers offer great services, but sadly, many of them are not as slick as they seem.

This article has reviewed the most popular and well-known brokers in the UK.

However, we should always be careful of brokers because we have to remember they make a commission on our dealing activity.

Many online brokers send out alerts on hot stocks and events because they want us to trade. They don’t care if we have an edge or even make money.

If we trade, they make money.

If you have ever seen the film “The Wolf of Wall Street” then you will remember that the stock brokers at Stratton Oakmont wanted their clients to buy as much as possible, regardless of the quality of the company.

In the UK, being pitched stocks over the phone will only happen if you open an advisory account – most accounts are execution-only (commonly abbreviated as XO).

There are genuine stock brokers out there who build long-lasting relationships with clients, but be careful as not all online brokers are as focused on your own success.

Which stock broker should I choose?

There is no right or wrong answer to this.

Many people – including myself – use several online brokers for different purposes. It’s important to understand what you want to get out of your stock broker.

First, we need to understand the different types of online stock brokers available…

Types of stockbrokers

- Execution only (XO) stockbrokers

- Spread bet providers

- Full service and advisory stockbrokers

Execution only (XO) stockbrokers

Execution Only stockbrokers, commonly referred to as XO stockbrokers, are brokers that will only act as a service for your wishes to deal in the market. They will only execute orders and not provide any advisory capacity.

In my opinion, everyone should be responsible for their own decisions, as stockbrokers have an incentive for us to trade. They earn a commission on each trade, and so the more we trade the more money stockbrokers make.

Execution stockbrokers are great for cheap dealing. Most of my online execution goes through IG Group.

Spread bet providers

Spread betting is a financial product that mimics the underlying asset without actually owning it. For a detailed walkthrough, read my guide on how to spread bet.

For example, we can place a ‘bet’ on a stock going up or down. However, spread betting is a form of leverage, meaning both gains and losses are magnified.

I would not recommend beginners to open a spread betting account as most people lose their money. If you have not traded consistently profitably for more than a year then you should not even consider opening a spread bet account.

Why would you open a leveraged account where your profits and losses are magnified if you are not making any money?

Due to new European Securities and Markets Authority (ESMA) regulation that came into force in 2018, anyone who is a retail client can no longer lose more than the amount of money deposited into the account. It is impossible to go into negative equity.

Anyone opening a spread bet account is automatically a retail client unless they make the conscious decision to become a professional-client, of which you need to meet stringent criteria.

The two spread bet providers I use are:

Full service and advisory stock brokers

A full-service stock broker offers a variety of resources – this can be investment research, access to initial public offerings (IPOs) and equity raises (placings), and telephone dealing.

Of course, fees with a full-service broker are much higher than those with traditional discount online execution-only brokers, and so it is worth making sure you are getting the benefit before routing all of your business through a full-service broker.

They can also offer stock at a discount to the current market price in the form of a share placing. This is when a company raises cash for new equity, though very often the price often trades at or below the share placing.

It is useful if we want to buy stock in size that we otherwise might not be able to buy at that price in the market.

However, most of these deals are poor and it is a case of saying no to many of them. For beginners, I would not recommend signing up to an advisory stockbroker unless they specifically want access to equity raise deals and are comfortable with the risk.

Despite being classed as ‘advisory’, stockbrokers will still earn a commission from any deal you take. It is always worth remembering that.

Conclusion

That’s it! We have covered many of the most popular best trading platforms and UK stock brokers.

These stockbrokers have different offerings and it is possible you may wish to sign up to several of these as I have.

Choosing your stock broker is an important decision as the fees and capabilities vary and so you should take time before committing capital to a broker.

Always ensure that any broker you open an account with is authorised and regulated by the FCA (Financial Conduct Authority) like all of the above stockbrokers in this article.

You should also make use of your annual £20,000 allowance for your Stocks & Shares ISA.

Any profits made in your ISA account are tax-free, and so it is possible to make any amount of money in these accounts over time and they will be free from tax.

Disclosure: This article contains affiliate likes for IG Index and Hargreaves Lansdown. These links come at no extra cost to you and these are brokers that I use myself.