Like many retail traders, you may not be aware of what an iceberg order is, how to identify them, and how to use iceberg orders to your advantage. Not understanding iceberg orders will impact your execution, which results in poorer P&L performance.

But don’t worry, in this article I’ll explain everything you need to know about iceberg orders, how they work, and how to use them.

What is an iceberg order?

Iceberg orders are large orders to buy or sell shares that are divided in several smaller orders. They are placed by traders and investors for the purpose of hiding the full order quantity to avoid disrupting trading markets with one large order.

Why use iceberg orders?

Iceberg orders allow traders to work orders in the market without having to reveal the full amount. For example, if you wished to sell 200,000 shares in a stock that typically trades less than 1m shares in a day, then anyone seeing your large sell order on the ask may be deterred from buying and the price may fall further.

Disguising your trading intentions is a way for large traders and institutional traders to hide their peak size and reduce the market impact of their orders.

However, if you were to work this in an iceberg order of five tranches of 40,000 shares each – then the full order does not need to be disclosed to the market. The iceberg’s hidden volume still keeps its time priority on the limit order book the same way as regular limit orders. The only difference is in the trade execution with each smaller order getting a new time stamp rather than printing the entire trade in one.

This also works the other way. If you were trying to buy a large amount of shares, other orders may jump ahead of you to try to get filled. This is because they know that underneath them is a large order ready to soak up any selling. Getting filled ahead of icebergs can sometimes be a good tactic.

How do iceberg orders work?

Iceberg orders work by splitting the order into tranches and placing these onto the market. Iceberg orders are also known as ‘reloaders’ due to the fact that once one tranche has executed the next tranche is instantly reloaded onto the order books.

Iceberg orders get their name from literal icebergs, as you can only see what is displayed above the water and not what lies beneath. This is much the same with the iceberg functionality of hiding the real order amount.

Example of an iceberg order

Icebergs are easy to spot on Level 2.

This is because once one tranche is executed the next part reloads.

Here is an example of an iceberg order. See you if can spot it.

Can you see the 5,658 automatic trade (AT) going through in the trades column repeatedly?

That’s because the 5,658 sell order on the ask is an iceberg order which is reloading each portion when it is hit.

How do you identify an iceberg order?

You can see above an example of an iceberg order. But here is how you can identify an iceberg order on the Level 2 order book:

- Check the trades column – if you see a print repeated it is a sign there is an iceberg

- Look at the bid/ask price to see if you can spot the same size and price of the print on the order book

- If you can find the potential iceberg then watch to see if it executes and reloads – if it does it’s an iceberg

How do I place an iceberg order?

Iceberg orders can be placed on trading platform providers that offer Direct Market Access (DMA).

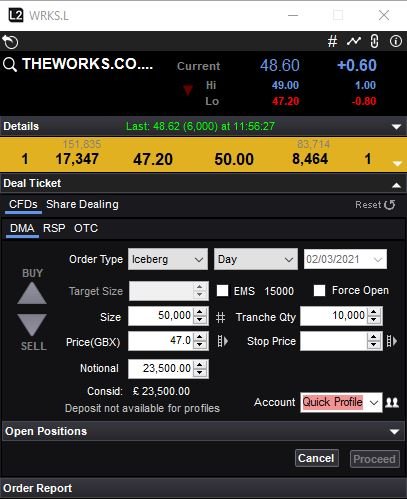

I use IG as it is the best provider on the market. It has its faults but I have found the L2 Dealer platform reliable when other brokers have been down. IG offers different orders such as a market order (use this order sparingly) and limit orders.

To place an iceberg order, open a dealing ticket and go to “Order Type”. This will automatically be set to limit orders by default. We need to change this to iceberg.

From there, we input our total order size. In this example, I am placing an iceberg order of 50,000 shares, with a price of 47p. This gives us a notional value of £23,500.

On the right of the “Size” box, you can see “Tranche Qty”. This box is asking is to put in our tranche quantity. I have put in 10,000 shares, and so this will place five tranches of 10,000 onto the order book – each reloading when the previous smaller order is filled.

One of the advantages of iceberg orders is that you can break down a large trade into hidden orders. You can also benefit from hidden liquidity as nobody will know the full order exposure due to the hidden part of the iceberg.

Market maker iceberg orders

The SETSqx trading platform does not allow for iceberg orders. Dealing with market makers involves electronic quotes and we are at the mercy of them for liquidity.

One trick market makers like to play is to offer the stock thinly so people feel there is not much stock around. But if you clear the market maker out of that stock suddenly they now have move stock! Market makers only display size they want to show rather than their full hand, keeping reserve orders out of show.

This could be because they’re working an order for institutional investors or because it suits them to do so.

Many market makers use algorithms and software to shut off and control electronic quotes.

Conclusion

Iceberg orders are a way of keeping transaction costs down and reducing your own effect on price moves. If you are working a large buy order, then you can set a limit on the bid price.

You won’t jump to the end of the queue when each tranche is filled either hence why icebergs are popular.

Many market participants use iceberg orders to avoid affecting the market price and to escape detection. If you spot an iceberg on the book, there is only an estimation you can make as for its true size. A detected iceberg can be hit repeatedly in quick succession and clear quickly or take an entire day or days to work.