Disclosure: This information came from my account manager at IG and communications from IG. However, it could change at any point. You should speak to IG before making any decisions so you receive up-to-date information.

- IG is increasing margin requirements on 1,000+ stocks

- Clients have until Friday 26 February 2021 to put up 100% margin on stocks affected

- Positions will either be forcibly closed or kept open for another 30 days

Should you still use IG Index? Read my IG review.

IG account managers began contacting clients last week that various stocks would go to 100% margin.

This is because IG’s prime brokers have demanded more capital for its positions.

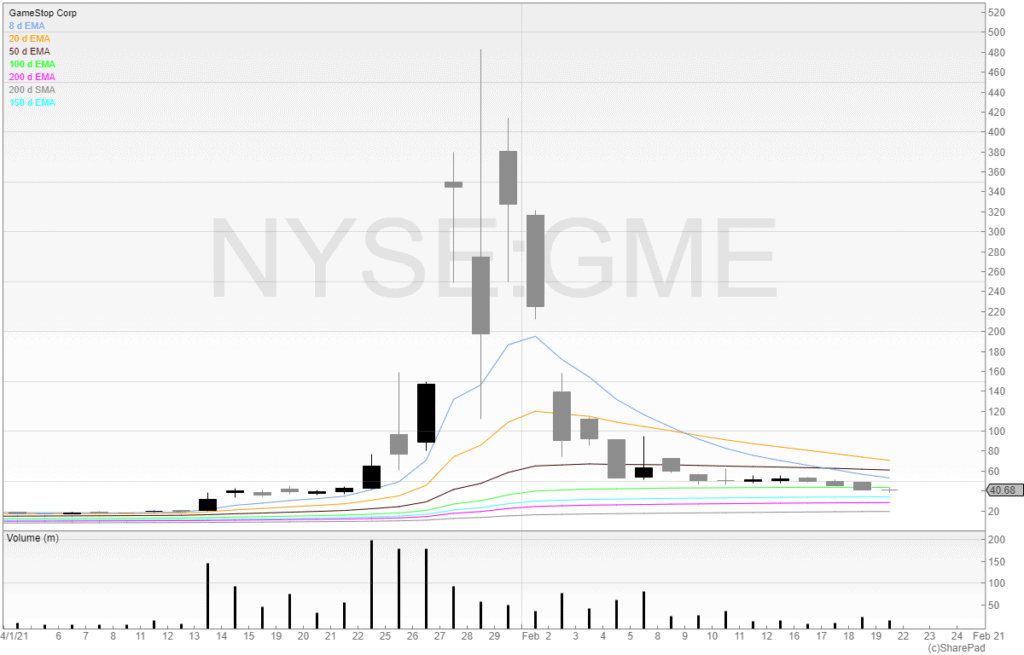

GameStop is partly to blame for this.

The stratospheric rise which saw many prime brokers demanding more capital from its clients – hence why trading platforms such as Robinhood were no longer able to offer positions – has meant that nobody wants to be left taking the risk and holding the baby.

In some instances, IG is now unable to commercially offer leverage on certain stocks as the money IG is being asked to put up as margin with the prime brokers may be more than IG is asking from clients.

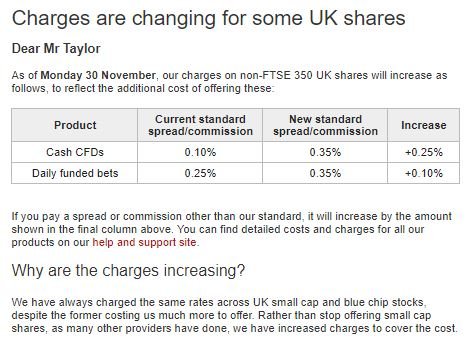

The small caps leverage business is costly. We already know that as on 16 November 2020 IG sent an email out to its clients that the commission rates would increase as high as 250%.

But just as IG clients are at the mercy of IG, so too is IG to its prime.

If nobody is willing to make a market on commercially attractive terms – then there will be no market.

These changes affect both retail and professional clients.

What happens now?

An email was sent out last week with a handful of stocks that were moving to 100% margin.

This was a tell-tale sign that more would follow and as of last week I was told over 1,000 stocks would move to 100% margin.

You can download and see the full list here.

As it stands, there are still clients of IG who are yet to find out that some of their positions will be moving to 100% within just a few trading days.

Unless you have cash readily available then transferring or even selling elsewhere will be required.

Settling of stock can take several days before the proceeds of sales can be withdrawn and so it is inevitable that there is going to be forced dumping of stock.

IG has given preferential treatment to clients and allowed them to potentially get better prices by exiting stocks and get ahead of others by short selling the popular retail stocks moving to 100% margin.

What if I am affected?

If IG contact you then you will have only a few working days to find the capital to meet the margin requirement.

From what I understand if you’re unable to meet the margin requirement you will be forcibly closed out.

If you do meet the margin requirement then from then onwards you will then have 30 days to close the position.

This leaves you with two options:

- Close the position entirely

- Sell the position to an ISA or share dealing account

If you sell to an ISA or share dealing account then you will already need the available cash in that account.

For a £20,000 position in a spread bet account moving to 100% margin the funds will be required to meet the margin and secondly another £20,000 will be required in order to buy the position from the spread bet account.

Spread bet and CFDs are derivatives and so it is not possible to simply transfer the position to another account.

What happens next?

Ever since IG decided to put its rates up for both professional and retail clients I decided to try to find another option.

There isn’t another UK broker that offers the broad range in UK stocks for CFDs.

There are various CFD providers that offer plenty of SETS stocks but nobody else has RSP access for CFDs other than IG.

IG exiting the market leaves a big gap. But if nobody can offer it viably then nobody will.

However, Spreadex is a popular alternative to IG.

Is Spreadex an alternative option?

Currently (as of 19 February 2021), there are no plans at Spreadex to increase margin rates, but Spreadex must do as their prime says. If the prime demands more capital, then Spreadex will have no choice.

The majority of leveraged traders lose money (MiFID-II requires all CFD and spread bet providers to disclose this clearly on their websites) so this could be a step forward in saving retail traders money.

But it’s likely to annoy those profitable traders who can make their capital work harder in the market by magnifying profits.

One option for professional clients is to go through the option of Title Transfer.

What is Title Transfer?

A Title Transfer is where a client of IG can exempt themselves from the necessary segregation of client funds. This means that anyone undertaking a Title Transfer is giving IG free use of their funds in exchange for zero protection but improved margin terms.

IG say that it can offer commercially attractive terms. However, anyone opting for Title Transfer assumes the credit risk.

Professional traders with IG still benefit from the £80,000 protection from the Financial Services Compensation Scheme (FSCS). But anyone who opts for Title Transfer will lose this completely.

Here is what IG says on the subject:

“Title Transfer (“TT”) is effectively an exemption from the normal client money rules that require firms to protect client cash by holding it in an account segregated from the firm’s own funds. This exemption only exists with respect to professional clients and cannot be applied to retail. It can only be applied with the client’s express consent.

Clients that transfer their cash to IG under a TT agreement are in effect giving IG free use of those funds to conduct its own business. IG is not obliged to segregate those funds from its own and may pass it through to hedging brokers to meet external margin requirements. As a consequence, clients are directly exposed to IG for the value of their funds held on account in the event that IG defaults.”

Basically, anyone signing up to Title Transfer may benefit from lower margin rates/commissions, but if IG go under then say goodbye to your money.

It remains to be seen whether these are temporary or permanent changes. Nobody knows. But one thing is for sure: these businesses are in it for profit.

If the prime brokers feel that the potential profits are not worth the risk, then this could be the end of leveraged trading as we have known it in recent years.

My thoughts

This has been handled disastrously by IG.

IG has created an unfair market by selectively telling some clients before the rest of its client base.

All traders know that information is key.

I had the opportunity to exit stocks at better prices ahead of potential forced sellers.

I also had the opportunity (had I wanted) to short popular retail stocks knowing they would be shaken by market makers and sold by people unable to meet the margin commitments.

These sentiments are echoed by others too, with one trader calling for IG to give him a sell price at Friday’s close.

I am expecting more stocks to be added (more have already been added to the initial amount last week) and so there is likely to be some turbulence in the weeks ahead.

If you found this article helpful – please share it with others.

You can sign up to my monthly trading newsletter Buy The Breakout and see what others are saying here.