This interview was the result of a phone call between Morley and I in early November 2018. Morley is a full time stock trader and likes to trade commodity stocks.

Please tell us a little about yourself Morley.

I’m twenty-four and I’m now in my sixth year of being a full time, cash equities trader.

How did you get involved in the stock market?

Truth be told, I fell into the stock market as a result of a computer game I played when I was about nine – NeoPets. At the time they had a stock exchange and I can still remember today how excited I was every morning to check the value of my positions at the open.

There was nothing sophisticated about it, but it got me hooked young and I tried to persuade my parents at several points to let me open a trading account in my late childhood and early teenage years.

Was this like a tamagotchi online?

Kind of. So there used to be all these games and stuff and you could buy things for your pets, and my one was called a “Blumeroo”, which was like a cross between a kangaroo and what looked like a sort of starry nosed mole rat, and anyway you use to play these games online. They were kind of like mini worlds and I can remember finding the NeoPets stock exchange, and quite clearly it was completely random, but I remember it used to open at around 7 AM or something, so I’d be there getting ready to see how that price would reopen every day.

So was the price determined on buys or sells or completely random as in it made up a new price every day?

As far as I’m aware it was completely random and I don’t even think it quoted different prices in the day, so just a new opening price, it was kind of like these shitty OTC markets where you get one price and that’s it. It was great though! It got me totally hooked.

When did you actually ask your parents to get an account?

Well, I tried asking them several times. I tried asking them when I was 11, and they wouldn’t let me, and I kept asking them again at various points. I opened my first trading account about three months after my 18th birthday, so it was about Christmas time in my final year of sixth form, and my Mum said “Go on then, you’ve been asking for this for years, go and open yourself a trading account, here’s a thousand pounds to go and learn the ropes with it”, and I kind of started with that. When I left school I had a discussion with my parents and they decided that they would support me in taking a chance in trading full time. I was very lucky that I had them as a safety net – I’m not convinced I would have had the bottle to have done it otherwise, and I just fell completely in love with it, and just kept going really.

Yes. I know the feeling! So how long did the £1,000 last?

Do you know what? I don’t think I ever completely tanked it off the top of my head, because at the time I was buying things like Tesco shares, Lloyds, that kind of stuff. What I really learned in that kind of case was that they were good trades but they were in such small size that it would take me hundreds of percent to make any money.. Like you can’t buy £300 of Lloyds shares and expect to make, you know, a killing because you need to get over 10% to just get over the spread cost and the commission and any other fees.

So how did you combat that? Did you ask for more money?

Oh no, I combated that basically by learning in those sizes and making the obvious mistakes early on, and then pretty much after that point when I finally left sixth form, that’s when I found all the shit stirrers. I can remember my first proper trade that I made serious money on was Motive Television, and it basically just had one of those classic Motive Television placing ramps, and it just went nuts, and I made £2,500.

So was this from the same £1,000?

This would’ve been with a bit more, as I had added more money to my trading account by that point, but I can’t remember what it was. But I certainly added more when I left sixth form from my savings, and it went on this massive ramp and at one point I was actually up £12,000 on it from when I bought it, but I kept trying to sell the damn thing and it went to negotiated trade. I just wasn’t sophisticated enough at the time to know how to get round it, because I was trying to sell a lot of stock, about £14,000 worth, in a really shitty company, so of course they didn’t want to take it off me in one go.

So you tried to sell, but you couldn’t sell, and it kept going back down?

Yeah and it kept going back and I ended up selling it for £2,500 or something like that.

Did the system not let you sell if it went to negotiated trade?

No, it’s more that I was an idiot and didn’t press sell! What you have to remember is that I was not that sophisticated back then, I had never read any of the classic trading books, and still haven‘t; I learn entirely from experience and my own mistakes and that’s basically it. But you know for me at the age of 18 that was still a massive amount of money, and that wasn’t even the end of that first month. By the end of the month I’d actually made £4,448.05 and it would have been a lot more if I had properly understood how to route trades to avoid the Negotiated Trade system, pretty much from Motive Television and oh, what was that company, it was a really shitty airline, can you remember it?

Fastjet (EPIC: FJET)?

I don’t think it was Fastjet it was another one, it was so shitty that I think there was some sort of fraud case on it, I can’t remember now.

I can’t even remember Motive Television!

They delisted a while ago.

What happened after Motive Television?

There was another enormous placing ramp which was the usual crap and used to happen every six months where someone would come out of the woodwork and say “Guys, there’s going to be, wait for it, a contract with Apple and the share price is being suppressed in order to let them load up”, at which point someone would get in on the back of it and the whole thing would ramp up, and then they’d place, and then rinse and repeat six months later.

That’s brilliant – those stocks are great where you can just ride the ramps.

Yes, when I first started trading full time I made the majority of my profit from trading the ramps that preceded fundraises in nano-caps. They used to be really quite barn door obvious back then, so much so that you could actually use that as a strategy. It’s safe to say that there were and still are so many lies and frauds going around in the small and nano-caps in particular that they blend into one after a while. There was a stage a few years back when anyone could write a blog on a company and its stock price could go on a long run upwards as a result of it. Rarely did the expected catalysts stated in these blogs ever materialise – although as night follows day, a fund raise was waiting around the corner in almost all the blogs I can remember. I sleep much better at night now I have only a few of these minnows on my book at any one time!

I’ll always remember the famous CloudTag (EPIC: CTAG) blog. That was the ramp of the year.

After MTV [Motive Television] I can remember I had one losing trade where I lost £100 or something, off the top of my head I can’t remember, but it was a small company that went against me.

Travel Zest – I’ve remembered it! I made another £2,000 on that, and it was the same thing, it was basically “There is a placing coming, let’s ramp the arse off it beforehand”, and so that’s kind of how my first strategy evolved. I was never in any of the dodgy placings by the way – I’ve never taken any placing in fact.

By that point obviously I had arrogance streaming out of my ears and rather appropriately a few months later I’d lost around £7,000 on what is now, or certainly was, famed as Armadale Capital (EPIC: ACP).

Which one was that?

ACP.

That’s still going!

Is ACP still alive?

Doesn’t it do some sort of graphite stuff or something?

How have they not killed that off yet?! In any case that was an example of me getting hit on the wrong side of a trade and me thinking “This company will never place”.

Yes, it’s still going – just checked the chart.

That’s depressing, I thought that one would’ve died off, still a salary to be drawn I suppose!

Of course!

Well that’s kind of it, that was my first kind of strategy. I got capital injections at various points, and so in effect my strategy had to change because I had more money, and you can’t trade the same. That’s when I fell into more resource companies and mid caps, and that’s mainly where I stick now. It took me a long time to find out exactly what worked for me.

Well it seems to have gone well!

Well sometimes it goes well, and the problem is we all make mistakes in this game, as you well know, and I’ve had some horror stories on my book at the moment that I’ve only just got rid of. Whenever there is a horror story it’s always because I have not stuck to what I do best. And I do one thing very well and as soon as I don’t do that I lose money.

I think that’s true for most traders – when they veer off what doesn’t work or you don’t stick to your plan, you lose money.

There’s a hedge fund manager in Switzerland who used to have the phrase “do more of what works and less of what doesn’t” – and it’s completely true. I mean, if you can only do that and learn from your mistakes at the same time, you’ll basically win. I don’t think trading requires a lot of talent at all actually. I think it just requires methodology.

I agree. I think anyone can make money on the stock market regardless of how talented or intelligent they are, as long as they have something that works. So this £7,000 loss, how did that come about?

Oh yeah, ACP. I can remember it. They had some sort of placing, it must’ve been the classic shitty “We’re pleased to announce a placing, but it’s at a 50% discount – great news, the outlook is still great though!”

Yes, it’s amazing how many horrifically discounted placings have such great outlooks.

Yes, clearly you’re either a bullshitter, or an idiot, or both, whoever wrote that trading statement. But anyway I can remember the absolute horror, because it wasn’t even as if the price slid down, it literally just gapped 50% down, and I can remember being in tears, literally in tears at this point, because after having done so well at such a young age as well, thinking “Blimey, wow I’m amazing, I’m a god” to be then suddenly be thrown down hard on the concrete like that, I mean it was painful. Fortunately, I was smart enough that I took that loss there and then, and then I probably spent, oh God, probably about another hour crying I think, and then later on in the day I was like “Let’s get back to the grindstone, what are we going to buy next!”

It never lasts that long, does it?

No – it never lasts that long!

So how much of a percentage of your portfolio was that? Was it fatal?

Let me work it out… Hang on, let me just type in some numbers.

Well roughly, was it 10%? Was it 30%?

Oh blimey no, it was roughly 50% that I lost, I mean it was really early on, I’d had a meteoric rise up, and then I basically lost, it must’ve been 50-60%, I think less than 70.

Wow.

I know yeah, in one hit, it just went – bye.

That is pretty brutal. Did that not affect you for the next few months though, psychologically?

Yeah, it did, but what I would say it is that it was one of the most horrible experiences I’ve ever had, and probably the one I remember most, and actually going on from that, I’ve lost far more than that, even in single trades, in probably far worse situations.

Was that because it was your first time?

I think it was because my head was so inflated, because the problem is whenever you hear problems of traders it’s always you hear how they lost a lot of money to start with, and with me it was the exact opposite, I made a metric crap tonne of money (for me at least) to start with, and then I had the absolute horror of when it went wrong because it wasn’t like I fell from 0 to -10, it was like I fell from 100 all the way to -10, and it was just horrendous.

Yes I was similar, I made more than my annual salary in the first month and it just didn’t stop, then of course the election came, I was stuck in plenty of illiquid stocks and no real plan to get out of them. It taught me a lesson, and I think you only ever do it once, and never do it again… and if you do you’re an idiot.

True, but every now and then I still get caught in things and I still find myself doing things that are silly, and I’m thinking “Morley, you would never ever do anything like this”, and yet here I am, I’ve just done it, and I have to go back and think what in my plan went wrong.

Probably nothing – you just didn’t follow it!

Yes, that is surprisingly often the case!

That used to be the main reason for me too. Boredom trades used to be a problem for me, and that’s where I lost quite a bit of money, and as soon as I cut them out my results improved pretty much overnight. Not having a plan also crucified me, and I didn’t fancy it a second time.

For me it was cutting out day trading. I looked through my spread sheets over five years and said “Morley, you’re shit at day trading, just don’t do it!” When I looked at it, it was ridiculous, I mean it was way more than 50% of the day trades that I put on were losers, massively so, and this was news related day trades by the way, but small AIM companies with news, and I was losing on something like 70% of them. I stopped doing that and my P&L dramatically improved, because basically people who can trade on news are a really rare breed and normally they’ve got really good tech, they’ve got RSP feeds, Level 2 (which does help if you’re in it for ten minutes or less, in my opinion) and frankly they’re fast. Trading news is a real skill that I don’t have.

Now I also suspect that there are a lot of bullshitters. They’re not holding it as long as they claim to be, it’s when you get the classic “Guys, I’ve just 20 bagged this stock” – fuck off! No you didn’t! You sold it 10 minutes after it spiked for 20%, and that’s great but you know they really will bullshit you around, and if someone doesn’t put out a screenshot of what they bought and sold, especially if they’re claiming to do it all the time, I’d question how true it is. I know only a handful of guys who can day trade news on AIM well.

I know what you mean, for example so many people claim to have sold Physiomics [EPIC: PYC] at 30p [PYC spiked from 1.4p to 30p over the course of a few days in December 2017) and maybe they did, but it seems to be an abnormal amount who claim to have done so.

Let’s face it, someone has to print the low and the high of the day, but people really like to pretend they’re printing the highs, don’t they? No one ever tells you when they’re printing the lows.

Often a lot of people will tell you they’re buying the lows and then it drops further.

Yes, there’s something quite funny in this game too that people have quite ridiculous and unrealistic expectations of what percentage gains they should be looking for, and mainly its because of bullshitters claiming that they multibag things. And some guys do, I don’t want to deny that, you can multibag things, but most of them do it over a couple or several years as a rule. My music teacher for example, he was a buyer of Solomon Gold at 4p (EPIC: SOLG) and he’s still holding now, but he’s had that three or four years. So he’s massively quids in on it but it’s not like he was in and out, and some people make an assumption that you can be in and out with 100% easily, and you can’t! And even the guys that pretend that they can, most of them aren’t doing it.

Yes I agree – you get the rampers tweeting about a stock every thirty seconds claiming multibags and then you see their trades go through for 10% and they stop tweeting. What has been the biggest fraud you’ve seen?

Well I’ve been around for a few of them but it’s always much better to be on the side. There’s an idea isn’t there, that volatility is really important for traders dot dot dot… Well that’s fine, but only if you’ve got good enough risk management to be able to take that volatility on. Most people don’t, they really don’t, they can’t stand it emotionally, I can’t stand it emotionally. I actually find the volatility range for my trading and I stick to it, and as soon as the volatility range fits into the fraud category they generally are over a volatility range that’s way outside of my comfort zone. That’s a very boring answer really, isn’t it!

Definitely not – I think that’s a really good answer. Most people are thinking always about how much they can make but they forgot to think about how much they can lose. Everyone loves volatility as long as the price is going up!

That’s the other big problem isn’t it? Risk is ultimately subjective, and peoples’ ideas of reward are always skewed, massively, versus their idea of their risk, every time!

Yes, I think some people think they can risk 10% and make 100%, and when you think about it how often is that really going to happen? All that will happen is you constantly get stopped out and you’d need a 10% win rate to breakeven. Most people can’t handle that sort of win rate, I definitely can’t, I want to be winning as often as possible and giving as little back too. Winning only 10% of the time to bet net profitable must be incredibly tough.

You find yourself thinking “Mate, if the risk to reward was actually that good every time, everyone would be buying this. Everyone”.

And everyone would be making money!

And it comes back ultimately to be being honest with yourself, doesn’t it? Hardly anyone can be honest with themselves. If you can be honest to yourself and you’re prepared to learn, you can make money in this game.

Most people can’t though, and I suppose that’s why they don’t make money. Which is a shame because what we do isn’t difficult, it doesn’t require anything special, but it’s a simple process of learning, trials and errors, and doing what works. So what were your experiences of the Bitcoin bubble?

What I thought was most interesting about the Bitcoin bubble and what preceded it was how little it affected the larger markets and how much it did seem to affect the smaller markets. I can remember that retail traders I respected seemed to be blindly leaving the small cap equity markets where they made the majority of their profit to chase the expanding bitcoin bubble. At the time I still had a good amount of smaller cap exposure and it became noticeably harder to make money as a result of this drop in liquidity. More than just this, notable stock promoters became less active (presumably having moved to crypto) and so it became harder to get clear ideas of where the hot stocks were. Luckily by the time the bubble started to burst my positions were mainly commodity linked mid caps and I had effectively no crypto exposure on my book, so I came out of it very much unscathed.

Yes, me too, I didn’t make a single profit or loss on cryptocurrency. I don’t think it’s gone for good though, there’ll be a few more spikes in it over the years. What’s been the biggest spike or the best day on the stock market for you and how did you feel?

The strategies that I run now tend to mean I rarely have gigantic portfolio swings in a day as I’m often taking smaller profits regularly from the market. Certainly though, the days when unexpected takeovers come across my screen are usually the best. I’ve made some serious money from these and while it feels brilliant to be winning in large size out of the blue, I won’t pretend that any of these takeovers have been as a result of any personal skill I possess as a trader.

That’s pretty cool! I’ve not experienced a takeover yet. What do you think is the worst thing that has happened to someone else and what could they have done differently?

I think that bar having to take big losses the worst thing on a day to day basis that I see happening (and I’m guilty of this too) is people lying to themselves. The writing can be on the wall for a stock: bad management, low cash levels, poor business, the list goes on and yet people will tell them that it will all be all right in the end, or that it will come good somehow. They almost never do – lying to myself like this is the one mistake that I sadly still make from time to time.

I’ve done that too, I try to check my portfolio every night and ask myself “Should I really be holding this stock” to avoid stocks just sitting there and drifting. That’s the real killer. In my boredom trades I mentioned earlier I’d be buying something to try to make 10-15% and end up selling them at a loss for 20%, which was stupid! Did you ever think of giving up?

I’ve thought about quitting several times. I think that ultimately, even on the bad days, I just had a love for the markets that kept pulling me back to my desk. I’ve never had a proper holiday as a result, but I think that it’s very rare that people get to actually have their dream job and I’m lucky enough to have exactly that.

I think I’ll get that answer in a few of these interviews. How much do you think your life has changed by participating in the stock market?

I think that being active in financial markets teaches you a lot about detaching yourself from emotional situations. If you can’t detach yourself from your positions in the markets then you’ll never make a good trader.

Unsurprisingly, you learn a lot of basic business analysis skills from just reading financial reports, but I have found these to be surprisingly useful in everyday life: be it helping businesses raise debt financing, or even just to pitch things to investors in a sensible way. It’s useful knowledge that I draw on a lot outside of my day to day trading activity.

You mentioned earlier that your strategy had changed from the placing ramps, what is it like now?

Like all traders my strategy has reached where it is now from a long period of slowly working out what does and doesn’t work for me. I’ve tried trading in the same way as some of my friends do, but I just can’t do it. So much of being successful in this game is about finding what works for you and then not deviating from that strategy. I would say I have two strategies that work in tandem: firstly I try to find companies that generate lots of free cash compared to their market capitalisations – they usually end up being mid caps. It’s quite helpful if these companies are in the commodity sector, as it gives you extra data to use to determine where the underlying equity price might go. I generally buy up reasonable chunks of these companies – I aim to have around 10 or fewer companies on my book at any time.

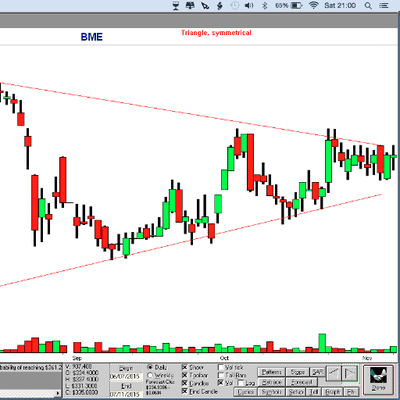

Secondly, I often tend to trade a certain percentage of my overall holding in any particular stock, which allows for shorter term swing trading opportunities over usually a few days. These trade are usually worked on trading an underlying commodity trend against the equity price of the company I hold. A recent text book example of this has been Ophir Energy (OPHR) where I was a buyer mainly ~39p, but then took about half off ~43p when oil was looking like it might be starting to top. I can then add these shares or more back at around a similar level to where I bought, depending on where oil moves to and the price of Ophir at the time. I think that trading around positions is an underused strategy. If you get it right then you can buy back more stock than you had beforehand and even if you get it wrong you are still locking in gains from the market and taking risk off the table. It’s a win/win situation in my book.

You are absolutely right; I’ve managed to accumulate more shares by trading around positions than I would have if I’d just held. Also you end up getting to know the stock and how it moves, and how it responds to news, so I think trading what you know is definitely good advice. What are three things you wished before you started in stocks and why?

Firstly, I think I would have to say that comments on stop losses in AIM in particular aren’t always helpful to newcomers to the market.

How do you mean?

Well, for example, people say stop losses don’t work on AIM, and maybe if they’re tight yes, but they take a lot of stress out of the game I think and even with the small caps, rarely does a stock have a significant drop that doesn’t coincide with bad news sooner or later. Having a stop (even if it’s 25% away from your entry price) can save a lot of pain for new traders. After all, if a stock falls 25% from your entry then you need it to rise 33% just to get back to your breakeven, so even a wide stop at 25% down could have saved me from a few 50% losses early on and the required 100% gain to get back to breakeven overall.

It’s a cliché but cutting losers and running winners is what trading is all about.

Another thing, try to be one or two steps in front of the market and not three or four because even in investing, if you’re too many steps in front of the market you risk taking big drawdowns, which not only stops you deploying capital elsewhere, but means that you can risk sacrificing a good amount of potential profit from not letting the price find a good floor before buying. Finally the old adage “If it sounds too good to be true, than it probably is” is almost always accurate in this game. When money becomes involved there are few you can trust.

That’s odd, because I’ve found the “no brainer” trades to sometimes be exactly that. I don’t know if that sort of intuition comes with experience of knowing what drives stocks up and down but there have been times where I thought “I should really take this trade”, then didn’t, only to watch it do exactly what I thought it would. But generally you’re right, if a stock only has positives and no negatives then there’s probably something you’re missing.

One of the reasons I like mid cap mining and oil and gas companies in particular is because almost all the information required to assess where company profits and cash flows are going can be worked out with a simple commodity price chart and a recent production report. Mid caps are a nice space where there isn’t too much institutional activity, they don’t attract as many liars and cheats as the small caps and you can capture some very large moves without having to take as many of the discounted fund raising risks associated with many of the small caps.

Some have done very well in those yes, recently as the liquidity dries up in the smaller stuff I am increasingly moving to more liquid companies and usually oilers. Swing trading can be quite profitable on these large companies as you up the stops and double the exposure, keeping the risk constant.

What’s really helped me with my swing trades, is literally saying “Right, I’m up 10%” so I’ll stick a stop in, and then it becomes win-win, the only way I can lose is if it gaps down or something and I get slipped. Because let’s face it at the end of the day, the best trading strategy is the one where you’re making money almost all of the time if a price falls back. I never want to be in a position where the price can fall back massively without me actually taking anything off the table as that’s happening

Yes, you’re definitely right, you need to protect what you’ve got. You need to play to win but you can’t win if you can’t play.

Also, you feel so much better and normally when the price is going against you there’s a damn good reason for it, and when you stick stops in on larger companies you’re almost always guaranteed to make money. Maybe not as much as when it goes on a huge run, but let’s face it, these things never go on a huge run. We are almost always at our most objective when we haven’t got a position’ it’s rare to find someone totally objective when they have got a position, and that in a way is why I like to plan all my trades in advance, so I’ve got that objectivity when I’m planning it, and from then on it’s just executing.

That’s really clever, I do actually try to do that, but I don’t always do it. Which is stupid because I know it works, which means I’m an idiot.

Well I think you’re being pretty harsh on yourself Michael, because I know you’re a very good trader!

Thank you, but it was stupid of me, and we are only as good as our trading systems allow. I think the trader with the better system and execution beats the trader with the best ideas and knowledge. What do you think makes a successful stock trader/investor?

A willingness to learn, take calculated risks and a love of the markets in general. All of the successful traders I know live and breathe financial markets; it’s an obsession for them.

What do you think has made you successful?

I suspect that when you boil it all down I’m really just good at not making the same mistake twice. If you can learn from your mistakes and keep your losses small, especially early on, then anyone has a good chance of success in the trading/investing game. Ultimately, most successful traders learn what works by losing money for a protracted period of time until they find what works. It’s a painful process, but it’s a necessary price to pay to learn how to trade with real money. I don’t subscribe to demo accounts – you need to have real skin in the game to have the proper emotional attachment to your positions in the market.

I agree, demo accounts don’t really work. Mainly because people aren’t invested in the outcome, and it’s play money. So they take a lot more risk naturally, because they’re completely detached. But you need to be somewhat invested in the outcome otherwise you won’t do the work to find the trades. I’m not saying be invested in the outcome of a trade, because generally that’s a bad idea and you should be detached from it and execute as your plan says, but be emotionally invested in the net result of your trading. If you’re not, then why would you bother to learn? That’s what happens with demo accounts. What do you think you would be doing if you weren’t doing stocks?

I’d like to think would be a musician. I deputise in cathedral choirs in my spare time and after ten years of singing lessons I think I’ve been pretty well trained. Although, as it currently stands anyone within quarter of a mile has to tolerate a constant barrage of Puccini arias anyway – so perhaps it’s for the good of mankind that I generally only sing for my own amusement!

Is that why you speak posh then? I always thought it was because you were a southerner! I think we’ve done all the questions now.

Do you know what, a really good question to add on, because I assume you’re speaking to others too, would be to ask “what would you do to improve the overall quality of the AIM market or markets in general”, something like that.

That is a brilliant question.

Because I’ve been thinking about this for a while, and let’s face it, the reason being that the AIM market is so crap is because of the ease of which people can take fundraises, and I meant that by either being a company or by being a PI. I think that you could clear up AIM really easily simply by having a lock-in period on any placing. If you locked people in for six months, three months, something like that I think you’d clear the market up. Shite companies would die off because no-one would take the placings, but also you’d get funding partners that are non-parasitic coming through, and you don’t get those whacks to the share price which mean they’re then forced to raise lower and lower later on.

That’s a really good point. But would you then not have people taking the placing and then shorting to hedge?

It’s a good question. I mean the advantage would be is that if you were locked in then presumably it would make it harder to do any sort of naughty deals with it because you can’t, I mean, you could use it as collateral on any synthetic short, if anyone would give you one, but even then you’ve still actually got that stock so it’s not like you’re just covering it with the stock because it’s your stock and you can’t hand it back to someone else at the end of your short.

I think that’s a great idea.

I think lock-ins would improve it vastly because shite companies die, and good companies get funding that isn’t actually pants to the share price.

What I would do as well is suspend the stock, do the fundraise, then open it up.

I know, that’s what they do almost everywhere else apart from here, it’s stupid. But that’s probably why AIM is so popular as a capital market because you can make a lot of money twatting around with these things.

Yes definitely. I still find it hard to believe though because it’s 2018 and it’s just not done. I remember being made inside on Gfinity (EPIC:GFIN) and the price was in the high 30s and I was nicely in profit, couldn’t sell at all though because I was inside, and then it obviously leaked and started falling, and then the placing price dropped lower, and by the time it was done it was in the low twenties, so I lost all my profit and more. It just dragged on for ages.

That is annoying. I can’t think of anything else I would add, can you?

No, I think what you’ve said is insightful, thank you very much for your time Morley!

Thank you, it’s been a pleasure.