Last month, I was involved in a private share placement for a stock I’m holding. It allowed me to get cheaper shares than the market price.

Share placings are a great addition to a trader’s arsenal and also for investors to increase their shareholdings and back their investments with capital.

However, share placings carry a degree of risk and many people can get burned if they don’t know what they’re doing.

This article covers share placements in detail and offers a guide to understand what placings are, how to get involved, and the advantages and disadvantages of private placements.

What is a share placement?

A share placing (or placement) is when new equity shares are issued to individual investors, corporate entities, or small groups of investors for capital. This increases the amount of shares in issue and dilutes existing shareholders. Share placings usually go to institutions to fund company growth.

What are conditional placing shares?

Conditional placing shares are shares that can only be issued if certain conditions are satisfied. This is usually due to a General Meeting (GM).

This is because a company has exhausted its existing headroom to allot shares and raise capital. Therefore, this corporate action needs to be approved by shareholders in order to go ahead.

For example, here is an RNS announcement from Cloudcall disclosing to the market a conditional placing.

Whenever you see this type of RNS you will see that the conditions of the placing are listed in the appendix of the announcement.

Depending on the regulator’s rules, a prospectus may be issued to cover the raise in more detail.

How does a placing affect share price?

How does a private placement work?

A private placement is the sale of company stock to select investors and institutions rather than on the open market. Companies can raise money through these secondary raises to expand operations and grow.

In the United Kingdom, companies raise capital through their corporate broker (who also act as advisers). The broker will contact institutions and private client brokers. Private client brokers are brokers who have the majority of their clients as individuals rather than institutions (often high net worth individuals or qualified investors).

Once the brokers contact their clients on behalf of the company, the institutions and clients are sent an invitation and must agree to the market sounding, and are given the details of the share placing.

The market sounding discloses the nature of the information as inside information, asks for compliance, and mentions that it is a criminal offence to trade, modify an existing order, or incite someone else to trade on the content of the company information.

Such persons who break the insider agreement may find themselves in hot water with the Financial Conduct Authority (FCA). Absolute discretion of the applicable law is required here.

Once the deadline for the fundraise closes (it may close early due to significant demand) then the allocations are given and the trade date set.

The broker will take a commission for undertaking the fundraise and the net proceeds of the placing will go to the company.

The placing is announced through the news service of the London Stock Exchange and those investors who were inside are now considered cleansed by the regulatory authority.

The date for the admission of the placing shares is also given.

Why do companies go for a private placement?

Companies go for a private placement for two reasons:

- To raise money

- To place existing shareholder stock

Raising money is the primary purpose of a stock market listing. Access to capital markets to raise funds for growth helps drive the business, and the increased liquidity in the stock and profile that comes with a listing are attractive too.

The second reason is to place existing shareholder stock. Larger shareholders that wish to sell can do so in an orderly transaction. This gives the seller a pre-agreed price before the sale to the buyer.

What is the difference between a private placement and an Initial Public Offering (IPO)?

An Initial Public Offering (IPO) is when a company has a public offering of securities for the first time. This can be both to raise capital and sell existing shareholders’ stock. Investors can subscribe for these shares in the offering.

A private placement is done when a company is already listed but either requires more capital or wishes to privately sell existing shareholders’ stock.

Both of these placings are similar however the former is when the company lists and the latter is when the company is already listed.

One advantage of existing shareholders selling stock is that it can remove any potential overhang in the stock.

What is a stock overhang?

A stock overhang is a block of shares that acts as a drag on the stock price due to its size. If it was sold into the market immediately it would depress the share price and so it tends to hang over the stock price until the seller is finished.

For example, if an institutional seller is unwinding a large position, it can deter buyers and also act as a lid on the price until the overhang is cleared.

If potential buyers are aware of the overhang then they can enter a discussion with the seller to privately place the stock rather than depress the market price of the stock.

Example of a stock overhang

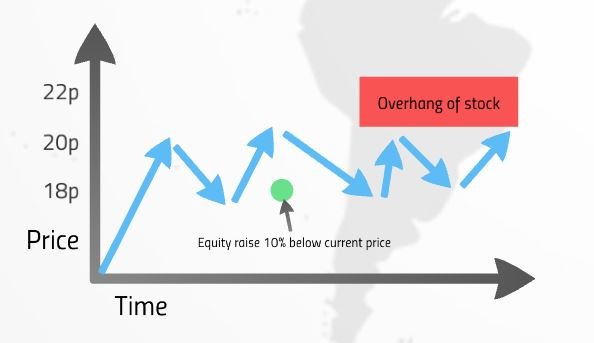

Here’s an example of a stock overhang.

The picture below shows an uptrending stock and a green dot where a private placement has taken place.

The stock often falls back because those in the placing may sell for a quick turn and existing holders may assume those in the placement will sell for a quick turn and so they sell themselves.

We can see in the above picture that the stock struggles to break through the 20p level because the 18p placing stock is being sold for a quick profit.

Once placing overhangs clear, the stock may see a further rally as the supply of stock coming into the market has eased.

Is a private placement good for a stock?

Private placements are neither good nor bad. It depends on several variables, such as:

- The price of the placing

- The amount of new ordinary shares issued

- The investors who take the placing

The placing price

The placing price will usually be at a discount to the prevailing price. This is because investors in the placing will want cheaper shares. Rarely is a placing done at a premium because then the investors could just buy in the market for cheaper.

A good placing is done at a relatively modest discount. A stock that is deeply discounted can suggest that the quality of the company is poor due to lack of investor demand.

The amount of new ordinary shares issued

The amount of shares issued is important because they increase the total number of shares in issue and dilute existing holders.

This means that the share price upside potential is reduced due to the increased amount of shares.

The investors who take the placing

The quality of the investors taking the placing is important. Would you rather institutional money who are going to hold their stock tightly? Or would you rather private investors who are looking to flip the stock and make a quick buck?

It can be useful to look out for holdings announcements to check which institutions followed their money. The merits of having a cornerstone investor who continuously backs the company can provide stability to the stock price when it comes to the placing agreement on the price.

Advantages of a private placement

One advantage of a private placing is that the company raises fresh capital

A cash boost strengthens the balance sheet and this can give clients confidence that the company has no liquidity concerns. Many Tier-1 companies will only deal with smaller companies if they are adequately funded.

Another advantage is that the company can use the capital to create shareholder value through investing in new projects

Funds can accelerate growth and this can attract new investors who push up the stock price.

Disadvantages of a private placement

One disadvantage of a private placing is that it can halt any momentum in the stock

When a company does a private placement, the investors who are getting the stock at a discount (known as ‘placees’) may sell for a quick flip.

This can create an overhang in the stock. If there was a placement to take out an existing overhang, then the new placees can become another overhang!

Another disadvantage of a private placement is that it dilutes the existing shareholders

When the total outstanding shares in issue increases this means that existing shareholders see their percentage shareholdings reduced.

Let’s look at dilution in more detail.

What is dilution?

Dilution means more shares in issue. This in turn means that our share of the company goes down.

Dilution also lowers a company’s earnings per share profit forecast as those profits are distributed against more shares.

Example of dilution

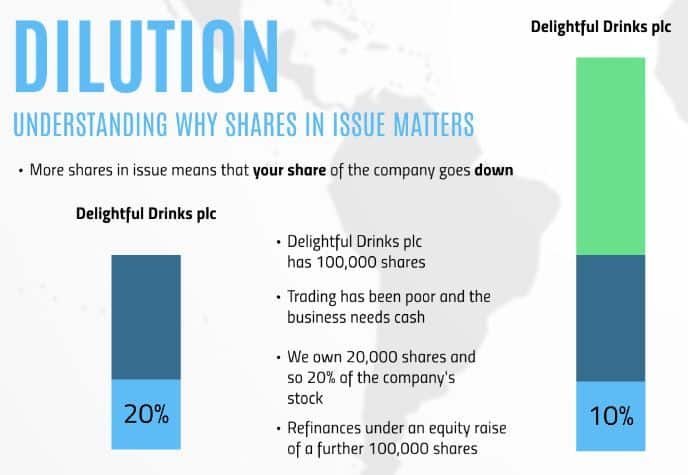

Let’s say that we have a shareholding in Delightful Drinks plc.

Delightful Drinks has 100,000 shares in issue. We own 20,000 shares and so we own 20% of the company’s stock.

However, trading has been poor so the company decides to refinance with an equity issuance of another 100,000 shares. We decide not to follow our money.

We can see in the picture above that with the new shares in issue (green) this now doubles the amount of total outstanding shares, and that our shareholding is diluted down to 10% of the company’s stock.

What is an accelerated bookbuild?

An accelerated bookbuild is a type of placing which is announced and completed quickly – often within hours. It is announced to the market and often has little to no marketing. The goal of an accelerated bookbuild is to get capital quickly into the business through price discovery as investors submit the sizes and prices they are happy to pay in respect of the placing.

Usually, a placing will be disclosed to certain institutions but this runs the risk of leaking. The accelerated bookbuild removes this risk.

Other types of placings include open offers and rights issues.

Examples of placing shares

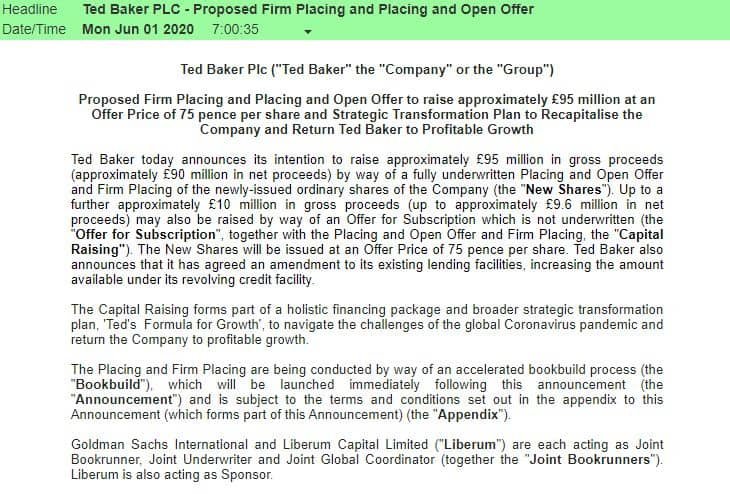

Here is an example of a placing in Ted Baker.

It was previously listed in the premium listing segment of the official list but the market cap has dropped significantly in recent years.

The RNS above includes a firm placing but also has acknowledgements to current shareholders as it announces the company will conduct an open offer too as well as an accelerated bookbuild.

As usual, all of the details such as the date of issue are provided in the appendix.

Stock through this placing is settled and delivered to nominees through respective brokers.

For example, if I take a placing at Pello Capita, the stock is delivered to Jarvis Investment Securities which is a nominee account.

What is a nominee account?

A nominee account is a firm whose name is on the actual securities it holds for the original customer. Nominee accounts act as custodians for shareholders.

What is a top up placing?

A top up placing is a colloquial term for a placing that simply ‘tops up’ the balance sheet. The company may already be in a strong financial position but decides to top up its cash reserves.

However, the reasons for any bolstering of cash reserves are vast.

How to spot when a placing is coming

There is no exact way to stop when a placing is coming but there are tell-tale signs.

- Find the cash balance of the company

- Look at the cash burn in the cash flow statement

- Check the recent RNS announcements

Find the cash balance of the company

Checking the balance sheet (learn how to read the balance sheet) will offer some clues.

You can find the cash balance of the company in current assets. Here is an example:

From there, we need to move to the cash flow statement.

Look at the cash burn

The cash flow statement takes the P&L and adds on the movements in cash (see an example walkthrough).

Therefore, we can see how much cash the company has burned through or generated in the financial period.

This will give you an idea of the company’s balance sheet as it stands today.

For example, if the company held £500,000 in cash on the balance sheet at the closing period, yet burned through £300,000 in the same six-month period, then it’s sensible to assume that a refinancing of the business may be required. This usually comes in the form of a discounted placing.

Check the recent RNS announcements

The RNS announcements can be a great way to spot an upcoming placing. A company that is in need of cash will want the placing price as high as possible.

One strategy to get a higher price is to put out puff pieces – RNS announcements that are light in detail but make the company look good. This can be done with RNS Reach.

If the company has started putting out lots of promotional pieces – perhaps there is a reason. It’s also possible that the company may use financial promotion and more publicity material too.

How to buy placing shares

To buy placing shares you need to sign up to a stockbroker that offers access to secondary raises.

Some of these brokers allow retail investors and some require you have two of the following three:

- €500,000 in an investment portfolio (excluding property)

- A minimum number of transactions completed above a certain size

- Professional experience

For the avoidance of doubt, please check with each specific broker as such information may vary from broker to broker.

To those who would like a recommendation, I have found Pello Capital to offer regular deals across both FTSE and AIM. I have no affiliation with Pello Capitaland have been a client since 2018.

It is rare that I take secondary placements but it is worth having access to deal flow if you are a serious trader.

You can check out the past performance of the stock by going to the company’s website or by using SharePad to analyse the company.

Sometimes the conditions of the placing will change. If they do then you as the purchaser are under no obligation to take the placing and you can pull out if the terms have changed so much you no longer like the deal.

If the deal is popular, then it is likely you will be subject to scaleback.

What is scaleback?

Scaleback is when a placing is heavily oversubscribed and the demand heavily outweighs supply.

For example, if a company was raising 500,000 shares at 100p, and orders for the fundraise came to 1,000,000 shares, then the placing would be 100% oversubscribed. It would be impossible for investors to receive the full amount unless the placing size was increased.

It would seem logical for all investors to receive half their allocation and be scaled back by 50%. However, this depends on the broker’s relationship with the house broker.

Actual results of what investors receive can vary. Some brokers can receive over double the amount that other brokers receive for their clients!

Conclusion

For further information, my book is an entry-level read on investing in the UK stock market.

Taking placings forms part of my trading strategy although this is not my primary trading strategy.

Sometimes the deal will be leaked – this is because the London Stock Exchange plc is not willing to suspend stocks whilst they undertake a fundraise.

The market in Australia does suspend stocks during this period, and the rules are also different in prominent markets such as Canada and South Africa.

This is harming the market and doing damage to both the main market and AIM-listed shares.

As always, this post is for informational purposes only with no accuracy guaranteed. Your investment activity is at your discretion and if in doubt please seek a regulated financial adviser who will be able to advise in accordance with your investment goals.