Many private investors and retail traders do not understand the difference between the London Stock Exchange‘s trading platforms. This means that they are not getting the best execution and leaving money on the table.

This is further exacerbated by the fact that there is little information on the topic readily available.

This article will walk through each trading platform with an explanation and how to apply the information.

What is SETS?

SETS is the London Stock Exchange‘s primary platform. It is an electronically matching order book where trades can be placed, modified, and deleted.

To access the SETS platform you need to use a broker that has Direct Market Access (DMA). This allows you to place DMA orders directly onto the order book rather than dealing through a Retail Service Provider (RSP) service which connects us to the market makers.

Stocks that trade on SETS include the United Kingdom‘s FTSE 100 constituents, the FTSE 250 stocks, FTSE Small Cap Index constituents, and other London-listed shares.

SETS auction times

SETS (Stock Exchange Electronic Trading Service) has two auction periods. There were previously three auction periods but I successfully campaigned alongside Investors Chronicle to remove the noon auction due to thin liquidity.

Currently, there are two auctions in the trading day. The opening auction at 08:00 when the market opens and the closing auction at 16:30 when the market closes.

There are also unscheduled auctions that trigger when the price crosses the percentage threshold since the previous uncrossing trade.

This varies depending on the stock’s Millennium exchange listing.

For example, stocks can see unscheduled auctions trigger when intraday news is announced from the RNS feed (the news service of the London Stock Exchange) and the price moves significantly.

Here is an example of a 1-minute chart from a SETS traded stock. We can see the grey column where the stock was in auction. This was due to a breach in the threshold price which triggered the auction.

The London Stock Exchange’s SETS trading platform is for liquid securities and my favourite trading platform as it is easy to get in and out of a stock.

What is SETSqx?

SETSqx is the second trading system on the London Stock Exchange. It stands for Stock Exchange Electronic Trading ServiceQuotes and Crosses.

This is a market maker driven platform whereby most of the trading is done by dealing with market makers either over the phone or via the RSP.

SETSqx low liquidity

There are often complaints – and justified ones – that there is a dearth of liquidity on SETSqx stocks.

This is because market makers have to make a book on these stocks. By offering a two-way price they are taking the market risk and for that we have to pay a premium through the bid-ask spread.

The bid-ask spread is the best bid and the best offer prices (ask price) as shown to us on a Level 2 screen (usually on the yellow strip).

If there is little liquidity on a stock, then the market makers won’t be keen to hold this stock.

Therefore, when requesting market maker quotes the bid-ask spread will be wider to reflect the heightened risk of the market makers dealing in this stock.

Naturally, this wider bid-ask spread only deters people from buying the company’s ordinary shares. And so the cycle continues!

SETSqx market makers

As mentioned above, dealing on SETSqx is done not through the electronic order book like on SETS but through third party market participants called market makers.

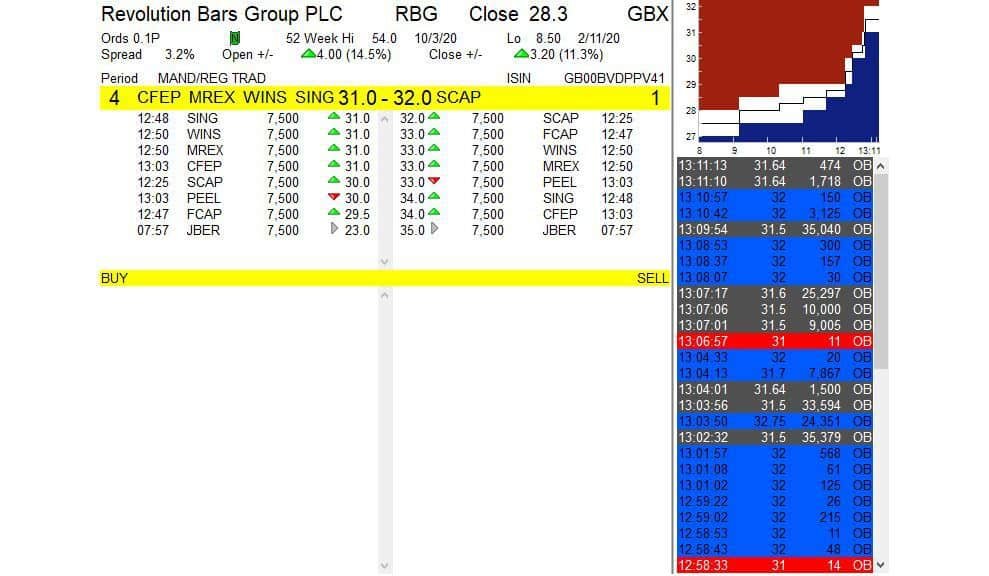

Here is a Level 2 SETSqx screen.

Market makers are obliged to offer a two-way transaction price on the particular security that they cover.

They are also obligated to deal in the size and price that they are at on the Level 2 screen. This is called the Exchange Market Size (EMS) but is commonly known as Normal Market Size (NMS) as this was its previous name.

Individual investors should be careful when trading on the London Stock Exchange’s SETSqx trading platform and always be aware of NMS before placing a trade. Smaller companies are often traded on SETSqx and sellers who wish to exit in a hurry may find they can’t sell without moving the price downwards on their way out.

However, market makers are not obliged to deal in the NMS when trading online via electronic quotes on platforms such as IG or Hargreaves Lansdown. But if you call your broker then the market makers are required to be firm.

Either your broker will call the market makers themselves, or in the case of one of my brokers, he shouts the order across to the dealers who will call the market maker.

SETSqx auction times

Like SETS, SETSqx also has the opening auction and closing auctions at 08:00 and 16:30.

However, it also has auctions at 09:00, 11:00, and 14:00.

These auctions suffer from thin liquidity and so often see little active participation.

SETS vs SETSqx: Main differences

There are several differences between SETS and SETSqx. Here are the main differences:

- SETS is traded via electronic orders and SETSqx is through market maker quotes and a periodic electronic auction book

- The closing auction sets the closing price on SETS whereas the mid-price is used on SETSqx if there is no uncrossing trade

- There is no SETSqx order book and stop losses can only be placed on the SETSqx system by using derivatives such as spread betting or CFDs

What is SEAQ?

SEAQ is the London Stock Exchange‘s Stock Exchange Automated Quotation System. It was replaced by SETSqx for all small-cap stocks that traded on SEAQ.

SEAQ uses non-electronically executable quotes that give market makers the ability to quote prices in a number of fixed interest securities.

Therefore, stock traders do not need to know anything about SEAQ unless they are interested in dealing in bonds.

SEAQ is London Stock Exchange‘s non-electronically executable quotation service that allows market makers to quote prices in a number of fixed interest securities.

Conclusion

SETS and SETSqx offer varying stocks and different trading possibilities. This article covers the differences in detail and if you want to deal live then you will need access to a Level 2 provider.

For further information on SETS and SETSqx, you can read my Level 2 trading walkthrough.