Trading journals are a necessary part of a trader’s daily life.

However, many traders don’t use a trading journal and as a result this lack of data means they are leaving money on the table. Even if traders do use a trading journal, the wrong KPIs can lead to poorer performance.

This article will walk you through everything you need to know about trading journals, including which trading points to collect and track, and how to build your own.

What is a trading journal?

A trading journal is a necessary tool for tracking a trader’s performance. Recording trades and reviewing the information allows a trader to improve their process. Trading journals can help identify mistakes that will improve a trader’s profit and loss (P&L).

Why you need a trading journal

The oft-quoted statistic is that 90% of traders lose money. I’m very sure that over 90% of traders do not keep a trading journal. There is clearly a positive correlation between losing money and not logging and analysing, but is there causation?

Learning from mistakes and holding oneself accountable would, in theory, improve results, so it would not be unreasonable to expect a positive correlation between traders who keep a journal and the increase of their P&Ls.

Trading journals are essential for performance management. This is for several reasons:

- Track trading performance

- Identify trading strengths

- Show trading weaknesses

- Regulate emotions

Track trading performance

It is essential to keep track of your trading performance. It is too easy to continually top up your trading account without realising that you are propping up losses. Having a good idea of your P&L will prevent you from burning through your cash.

Tracking your trading performance will also allow you to see how you’re doing versus a benchmark if you want to use one. I don’t use a benchmark myself because my trading account does not move in sync with the market due to its high position turnover rate.

Identify trading strengths

If I asked “What is your most profitable setup?”, could you tell me?

If not, why?

You should have a trading plan which defines your trading strategy. Without this it will be difficult to exercise any discipline.

Having a trading journal will show your previous trades where you make the most money. Once you know what is the most profitable setup you can then focus on finding more of these setups for the long term.

However, you won’t know which setups they are unless you track your trades and look to see which setups drive your P&L.

Show trading weaknesses

Just as a trading journal will help to identify your money makers it will also show you where you are losing or leaving money on the table.

Working on your weaknesses is a key part of any trader’s career. For example, one of my biggest weaknesses was cutting winners too early. I realised that I would often cut my positions too early and they would carry on without me after I’d taken a quick profit.

To improve on that I realised I needed to remove P&L from my trading account so I was not tempted to sell when I saw large £ gains. I learned to think in points and not pounds in order to detach myself emotionally from the money in my trading account.

Regulate emotions

Trading is both a physical and emotional sport. When real money is involved this exaggerates all emotions.

One issue new traders face is that of dealing with a big win. Large wins on a trade flood the prefrontal cortex with dopamine. This hit can become addictive which sees the trader take on more and more risk in order to get their fix.

I found that several losses would affect my confidence and make me hesitant to pull the trigger. This meant that sometimes I missed great trading opportunities because my psychological capital had taken a knock from a string of losers.

Losing is inevitable, and by keeping a trading journal this will reassure you that your system is profitable even if you do go through a losing streak.

If you don’t trade your P&L and instead focus on the process, this will benefit you in the long run.

Keep a diary of how you are feeling throughout the days and be honest with yourself. Most people aren’t able to do this, and this is a big reason why most people don’t make money in the market.

It’s always easier to blame something or someone else, and whether or not that blame is justified it still doesn’t help us towards our end goal of becoming and staying a consistently profitable trader.

Keeping a trading journal is a conscious step in the right direction towards your end goal.

How to keep a stock trading journal

A successful trading journal is built on consistency. That means recording trades and data on a daily basis in order to collect statistics from each single day. However, it can be a daunting process.

Let’s look at how to start a stock trading journal and what to include…

How to start a trading journal

The easiest way to start a trading journal is an A5 or A5 notebook and split the page into columns with your desired data collection points.

You can also create your own, or download the free stock trading journal template I’ve created below.

After about two weeks, you should have enough qualitative data to skim across and evaluate.

What was the main reason for buying? If you’re finding that you’re entering new positions because you’re bored, then obviously you need to stop punting stuff out of boredom.

If you can’t kick this habit easily then you’re not a trader – you’re a gambler. Close your trading account and go down to the casino instead.

You should also know why you’re closing positions. If you’re selling positions with no reason other than looking at the intraday price, is that definitely the most effective way? What is your risk/reward? What are obvious resistance points on the chart and are you selling anywhere near them?

What to include in a trading journal

There are three things that will boost your bottom line in trading, and those are:

- Ideas – generating more ideas will give you more opportunities to make money in the market

- Winners – working out how to make more money from your winners will mean profitable trades becoming even more profitable

- Losers – losing less in terms of batting average and percentage terms on your average losing trade will make a big difference to your equity curve

Focusing your KPIs on the process and not the absolute return will ensure that you monitor the measurements that will drive your return at the end of the year.

There are several components that go into a stock trading journal.

You can use this list below for ideas and maybe even add your own.

- Entry price and exit price of the trade

- Reason for the trade

- Position size and total trade quantum

- Closing profit or loss from the trade

- Trading diary

Entry and exit price of the trade

Logging the entry and exit price of the trade should be the first thing in a trading journal. Without this it is impossible to learn much from the trade.

Do you find you got stopped out a lot? Look at your entries – are they optimal? Are you placing them outside of stop loss liquidity?

By recording your entry you can go back and look at the price action at the time. You can also use the exit to see what happened after you closed the trade. Are you closing your positions too early? Should you run your winners harder?

This data will help you identify how to improve your entries and exits.

Reason for the trade

You should always include the reason (or the thought process) behind the trade. This means you can categorise trades. For example, is it a gap trade? Is it a fundamentals re-rating trade? Is a breakout trade?

It’s important to understand which type each trade is because without logging the reason you won’t be able to see which trade setups are most profitable. Once you know your best trades then your future trading decisions become much easier.

Position size and total trade quantum

Logging your position size and the total trade quantum is important because it will ensure you don’t trade too large a position. Oversized positions are the biggest cause of trading account blowups. Taking large losses can also have an effect on your psychology too.

By logging to position size and total quantum of the trade you can ensure you are sticking to your position size limits and also not taking on too much exposure in your trading account.

Closing profit or loss from the trade

This is an obvious one to include in a trading journal. Without the closing profit or loss from the trade you won’t know if you’re profitable or not.

Trading results should either be one of three outcomes. Small losses, small wins, and big wins. By avoiding big losses we can keep the account growing and compounding.

A trading diary

Noting your emotional feelings and thoughts at the time will help you to assess whether you’re trading as you should be.

Many a trader has succumbed to overconfidence and taken on more risk than they should’ve. I saw one trader go full tilt and average down into a rapidly falling stock price, only for the bad news to materialise the next morning and blow their account up.

You’re only ever one bad trade from losing everything. Keep a track of your emotions to ensure you stay in business.

Trading journal example

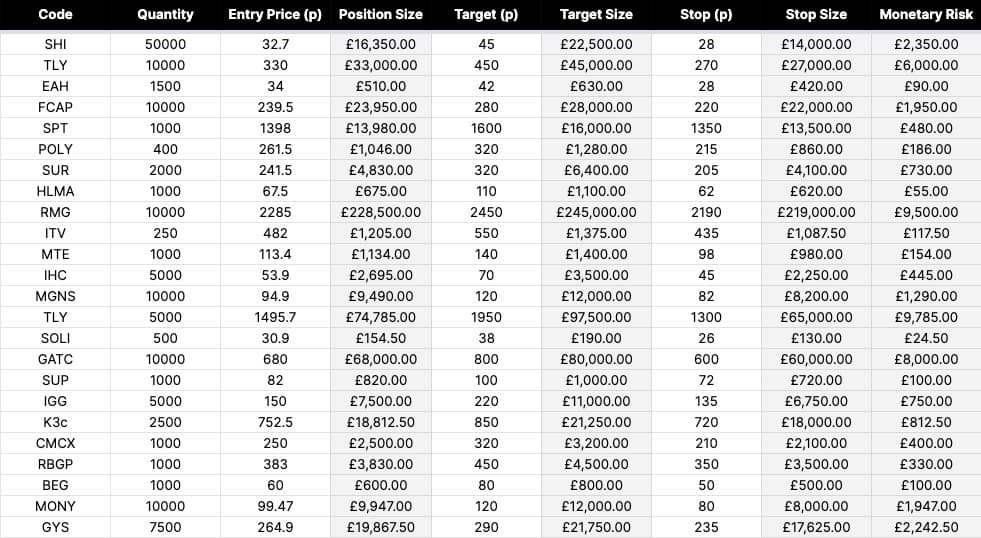

Here’s an example section of my my stock trading journal (if you’d like my free template, click the button below the image, enter your email, and I’ll send you a copy).

It contains several columns that you can input your data and will automatically calculate your position size, target size, stop size, as well as exposure and monetary risk.

Monetary risk is important because this is the loss you will take if you keep your loss to a minimum of 1R.

Therefore, you using this trading journal you’ll always know your maximum loss on the trade.

My trading journal also offers the opportunity to add notes on the trade, as well as the trade rationale and strategy. If you don’t know what the reason for the trade is then you shouldn’t take the trade!

Ensuring this column is filled in will mean that you won’t take boredom trades or trades that don’t fit your strategy.

Best trading journals to use (free and paid)

Here are the best trading journals to use to improve your trading.

SharePad

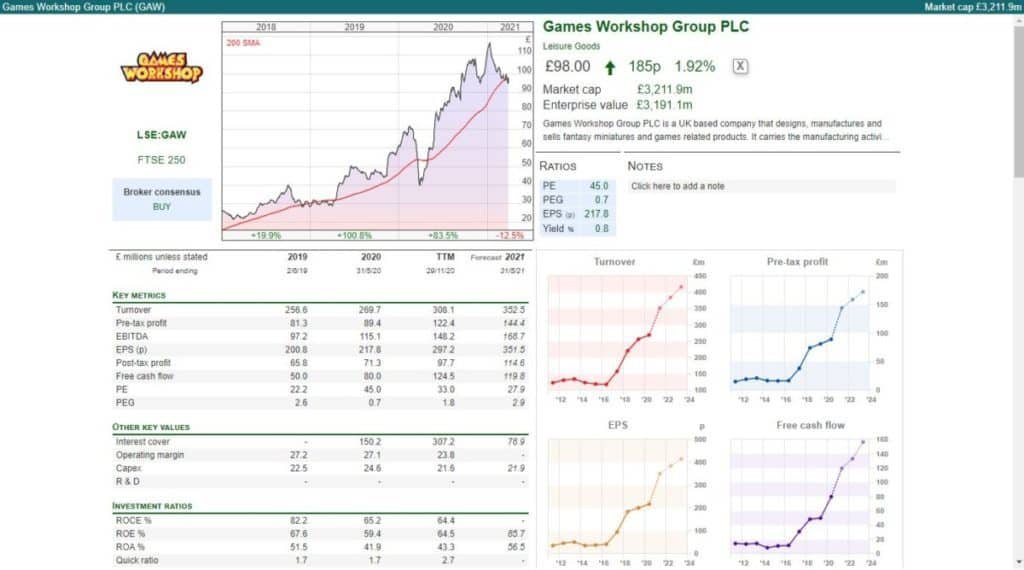

SharePad is a tool I use on a daily basis for tracking my watchlist and filtering for stocks.

Having all of this online means no mess and no hassle (the downside of this of course is that it is reliant on you having an internet connection – but who isn’t connected 24/7 these days?).

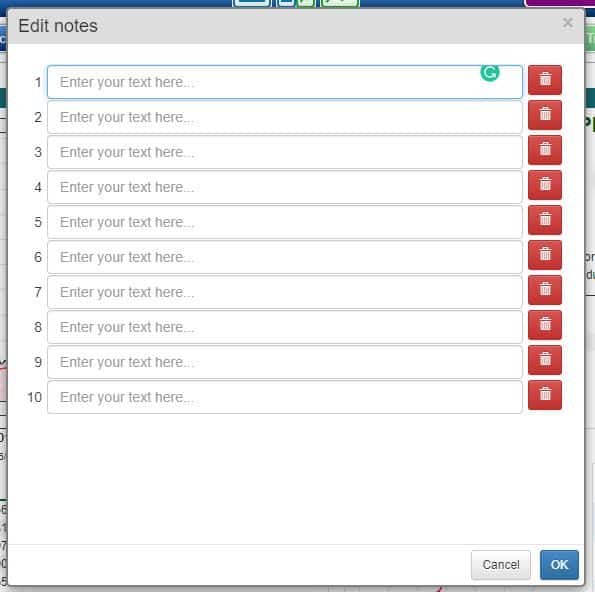

One useful feature of SharePad is that you can now use it as a notebook for trade notes.

Here is a screenshot from SharePad’s single page (more screenshots are available in my SharePad walkthrough and offer).

In the top right corner below notes we can see “Click here to add a note”.

This feature lets us write up to ten notes with ample room so it can also be used as trading journal software.

You can include lots of things here such as:

- Your entry

- Your exit

- Your position size

- Your stop loss and limit orders

- How you’re feeling emotionally

- How you managed the trade during the trade session

- What could’ve gone better and what went wrong

This functionality makes SharePad an excellent tool for traders who want to keep comprehensive notes in an easy to organise manner, as well as use for charting and filtering, and keeping track of trades and watchlists.

Excel or Google Sheet

Not a lot comes close to a simple Excel or Google sheet to track your trades.

As I showed you in the example above, you can use my free trading journal completely free. To get a copy, click the button below, enter your email, and I’ll send you a copy.

An A5 daily planner

For those who like doing things with pen and paper then a simple A5 daily planner is all you need.

You can include everything that you can include in SharePad notes.

There is no excuse for not keeping track of your trades and progress.

You can buy A5 daily planners for less than the cost of a cup of coffee.

How to create a trading journal

If none of the above are of interest, then you can build your own.

Realistically, fifteen minutes should be enough to jot down several things. I’d recommend including the below:

- What went wrong that day – this is important because when it is noticed then something can be done about it

- What you’re going to do to minimise or better prevent what went wrong from happening again

- What went right that day – it’s no good creating a journal just to give yourself a daily kicking – acknowledge success

- What you bought – position size, and why you bought

- What you sold, the sell points, and why

- Trade management – should you move up your stops and limits

- Time frames you’re using and why

- Brief ideas for tomorrow

Trade management

Many traders fail to realise that trade management is an area of their trading that is incredibly important to focus on.

The risk on the trade is never the same as when you open the trade, and new variables may come into play such as stock-specific news on industry-related events.

Forex traders will hold positions through NFP announcements and other macroeconomic factors.

How you manage your trades will be a big factor in your success and it’s important to document this.

Emotional analytics

Trading journals should also be used to track your emotions.

Many traders underestimate emotions but it is your emotions that will cause you to not stick to your trading plan, or succumb to FOMO, or do something silly like move your stop because your ego can’t take a loss.

Log how you feel throughout the trade and analyse the results.

Final thoughts on using a trading journal

There are three factors that will boost your P&L. Here is the trading equation.

Ideas * (average loss + average gain)

If you understand this equation, then you will understand what is necessary to become a consistently profitable trader.

More ideas, lower losers, and bigger winners. That is all we need.

You can add lots of different things from a trading system but if you can’t generate ideas you can’t trade.

If you can’t manage your losers you’ll go broke.

If you can’t make any money on your winners, then everything else doesn’t matter!

You will also be able to notice whether you’re sticking to your plans or not, which will show how disciplined you are. Discipline is everything in trading; those who lack it are soon unable to trade.

Ultimately, a trading journal will help you to make more money and succeed as a trader. Those who trade a financial instrument such as CFDs and spread bets will find trading journals even more important as these are leveraged instruments.

Spread betting can be lucrative but many who trade these products lose money overall. With a trading journal, at least you might stand a chance.

Become a better trader with SharePad. Use SharePad’s technique analysis suite and notes feature to create your own trading journal. SharePad gives me an advantage over the market and you can take a risk-free trial through me. Find out more