Many private investors don’t understand how uncrossing trades work. This means private investors often miss out on the best prices of the trading day. Furthermore, this lack of understanding costs them in terms of execution as we can use the uncrossing trade to work better prices.

This article will explain the uncrossing trade, how an uncrossing trade works, and how we can take part in the uncrossing trade.

What is an uncrossing trade?

An uncrossing trade is where buyers on the bid and sellers on the ask match together in a single trade at the end of an auction period. The uncrossing trade shows up with the trade code “UT” on the London Stock Exchange.

How does an uncrossing trade work?

An uncrossing trade will occur at the end of an auction’s call period if there is a match between the prices of both the bid side of the market and the ask side. It is the closing price for the auction on the LSE.

For example, if there is a price where both the seller and buyer can be satisfied, then the auction will disclose an indicative uncrossing price.

The indicative uncrossing price shows the price where the auction will uncross if there are no further orders or modifications to existing orders on the order book.

What is an auction’s call period?

The auction’s call period is the time where matched electronic trading is paused in order to collect buy and sell orders from the matched in an attempt to match them in the uncrossing trade.

The image below shows the auction process. Orders can be entered, modified, and deleted in the auction’s call period.

Once the call period finishes, the auction then enters a random 30 second uncrossing period before uncrossing.

The period before uncrossing is random because it ensures that only orders that are willing to be executed are on the book at this point.

If the uncrossing time was known, then everyone would either place their orders or withdraw their orders as late as possible in an attempt to game the system. The randomness ensures that nobody gets an unfair advantage.

Once the auction has finished with the uncrossing trade, electronic matched trading resumes.

Why is an uncrossing trade important?

The uncrossing trade is only important if you are involved in the auction.

Auctions can be great places to buy and sell stock. To get involved in the auction you need Direct Market Access. You will need to find a broker that offers this (I use IG).

Why should I get involved in the uncrossing trade?

Auctions can offer opportunities to get in and out competitively and the uncrossing trade is the result of matching between the demand (best bid) and supply of stock in the market in a single trade.

Stocks can gap up or down when there is overnight news when the market is closed.

In SETS stocks, the first trade of the day will be the uncrossing trade before electronic trading begins.

There are two auction periods on the London Stock Exchange after the midday auction was removed. I campaigned for this successfully alongside Investors’ Chronicle because the noon auction suffered from poor liquidity and was outdated in its then current form.

The two auctions that remain on SETS are the opening auctions and the closing auctions. The intra-day auction was removed in October 2020. For example, on Vodafone (a FTSE 100 stock) you now see continuous trading throughout the day unless there is an auction triggered.

The uncrossing trade in the closing auction is the last chance of the trading session to trade, as once uncrossing has taken place this is the last tradable price.

PRO TIP: Once uncrossing as taken place, any orders left on the book are live orders and tradable

A little known secret is that after the uncrossing it is still possible to trade at the uncrossing price if there are any orders left on the book.

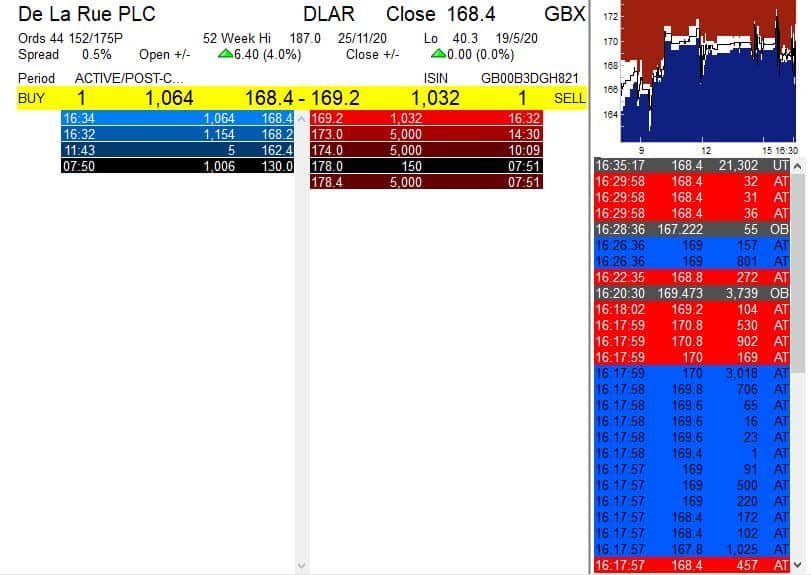

Below is a screenshot of De La Rue (DLAR) that has uncrossed at a price of 168.4p. We can see this because on Level 2 the uncrossing trade code is UT. We also know it will show a random 30 seconds after the closing auction’s call period has ended at 16:35.

We can see that there is an order left on the book at a price of 168.4p.

Using direct market access we can hit that order and trade even though the market has closed and the uncrossing trade has taken place.

How is the uncrossing trade matched?

The uncrossing trade is the result of all of the buys and sells in the call period being uncrossed at where the most volume can be matched.

For example, if there is a buy order at 105p and a sell order at 102p it is clear that there is a match. The buyer is willing to pay 3p more than the sell order in the call period.

However, the actual uncrossing price depends on the volume. If the 102p sell order is in the size of 10,000 shares and the buy order of 105p is firm for 15,000 then the auction will uncross at 105p with 10,000 shares matched.

The remaining 5,000 will go on the electronic order book as an automatic trade on SETS or into the next auction on SETSqx (market maker only stocks).

Here is where it gets interesting. If the buy order was for 8,000 shares only at 105p (below the 10,000 shares for sale at 102p) then the auction would uncross at 102p. This is because the demand for stock was lower than the demand to sell and so the auction takes this into account.

Auctions are based on supply and demand and it is this that sets the uncrossing price.

The uncrossing trade can be delayed if the indicative uncrossing price is above or below a certain threshold of the current share price.

The risks of the uncrossing trade

When trying to get involved in the uncrossing trade many retail traders can make the mistake of believing that the best way to be in the uncrossing trade is by submitting a market order in the auction.

This is dangerous. An astute market participant on the other side of the trade can exploit this and fill you with a much higher price than you had intended.

PRO TIP: Never submit a market order into a market auction – you are giving the market a blank cheque to fill you at any price.

An offer price order that is blank can be filled in an uncrossing trade at a stock price way above your expectations. Likewise, a market sell order can be filled at the lowest price of the day leaving you to feel robbed.

SETS auctions can be triggered intraday due to volatility and a price rise above a certain threshold – this can be due to an RNS in real-time and is part of the SETS system.

The SETSqx trading system does not have unscheduled intraday auctions as orders are dealt with via the market makers.

In contra to many retail traders’ beliefs, an auction in SETSqx does not mean anything other than it is already scheduled. However, auctions here can be good ways to pick up stock below the mid-price and in a size larger than the normal market size (NMS) if someone has accidentally left a sell order on the book.

Just be careful that nobody else spots it and pips you leaving you with just a single share.

Conclusion

The uncrossing trade is an important part of auctions, and auctions are a great opportunity to pick up and sell at great prices.

Understanding how the uncrossing trade works mean you can now take part in auctions and bid for stock and offer stock out for sale.

You will need direct market access in order to participate in auctions or you will need to call your broker and ask them to do this for you. The downside of the latter is that you will then need to call your broker to adjust the price or pull your order from the book and so I only use IG in order to do this.