Coupon yield is an important concept in the world of bond investments. If you are looking to invest in bonds or simply want to expand your knowledge in the financial field, understanding coupon yield is crucial. In this comprehensive guide, we will explore the basics of coupon yield, factors that influence it, how to calculate it, and its risks and benefits. So, let’s dive in and unravel the mysteries behind coupon yield.

Understanding the Basics of Coupon Yield

When it comes to investing in bonds, it’s essential to understand the concept of coupon yield. Coupon yield refers to the annual interest rate that a bondholder receives based on the bond’s face value. This interest is expressed as a percentage and is typically paid in fixed intervals, such as semi-annually or annually.

But what does this mean in practical terms? Well, imagine you invest in a bond with a face value of $1,000 and a coupon yield of 5%. This means that you will receive $50 in interest payments each year until the bond matures. It’s important to note that the coupon yield is determined at the time of issuance and remains constant throughout the life of the bond, unless the issuer defaults.

Now, you might be wondering why bond issuers pay interest to bondholders. The reason is simple: when you invest in bonds, you are essentially lending money to the bond issuer, whether it’s a government or a corporation. In return for your investment, the issuer promises to pay you interest in the form of coupon payments until the bond reaches its maturity date.

Importance of Coupon Yield in Bond Investment

Now that we have a clear understanding of what coupon yield is, let’s explore why it is crucial in bond investment. Coupon yield plays a vital role in helping investors gauge the potential return on their investment. By knowing the coupon yield, investors can estimate the income they will earn from a bond over time.

For example, if you are considering investing in a bond with a higher coupon yield, you can expect to receive more interest payments, resulting in a higher return on your investment. On the other hand, bonds with lower coupon yields may offer lower returns but may have other attractive features, such as lower risk.

Additionally, coupon yield also plays a significant role in determining the market price of a bond. When interest rates rise, newly issued bonds tend to have higher coupon yields to attract investors. This means that existing bonds with lower coupon yields become less attractive in comparison. As a result, the price of existing bonds may decrease, which is an important factor to consider if you plan to trade or sell your bonds before they reach maturity.

Understanding the basics of coupon yield is essential for any investor looking to enter the bond market. By grasping this concept, you can make informed decisions about which bonds to invest in and assess the potential returns and risks associated with your investment.

Factors Influencing Coupon Yield

The coupon yield of a bond is influenced by various factors, including interest rates and the bond’s maturity date. Understanding these factors is essential for investors to make informed decisions about their bond investments.

Interest Rates and Their Impact

One of the primary factors that influence coupon yield is interest rates. Coupon yields are generally affected by prevailing market interest rates. If market interest rates increase after a bond has been issued, the bond’s coupon yield may become relatively lower compared to newer bonds with higher coupon yields. This is because investors can now obtain higher yields by investing in newly issued bonds.

Conversely, if market interest rates decrease, the bond’s coupon yield may become relatively higher compared to new bonds. In this scenario, the bond becomes more attractive to investors as it offers a higher yield compared to newly issued bonds with lower coupon rates.

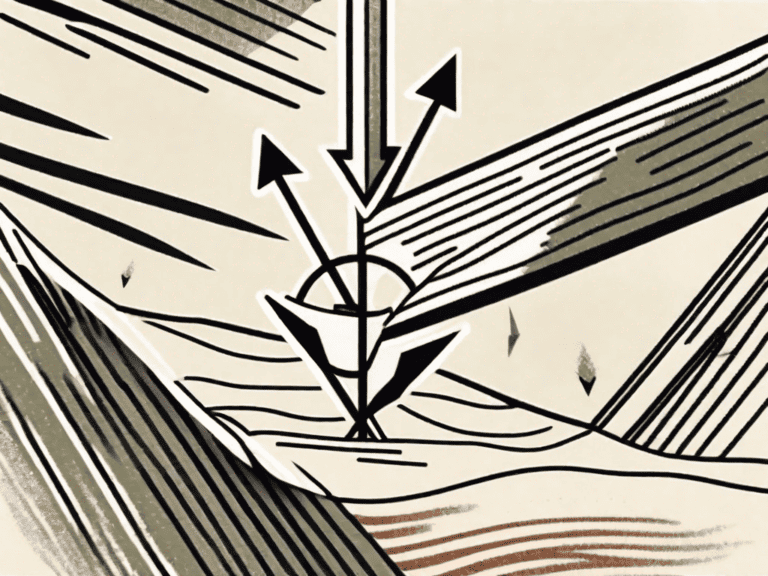

It’s essential to note that changes in interest rates can also impact the price of existing bonds in the secondary market. When market interest rates rise, the price of existing bonds generally decreases. This inverse relationship between interest rates and bond prices is known as interest rate risk. Investors need to consider this risk when evaluating the potential returns of their bond investments.

The Role of Bond’s Maturity Date

Bond maturity also affects coupon yield. Longer-term bonds typically offer higher coupon yields compared to shorter-term bonds. The reason behind this is that longer-term bonds carry higher risks due to potential interest rate fluctuations and inflation over a more extended period.

Investors who are willing to tie up their money for a more extended period may seek the potentially higher returns offered by longer-term bonds. However, it’s crucial to carefully consider your investment goals and risk tolerance before opting for longer-term bonds. While they may offer higher coupon yields, they also come with increased risks and uncertainties.

On the other hand, shorter-term bonds provide investors with more flexibility and liquidity. They are less exposed to interest rate fluctuations and inflation risks over a shorter period. Investors who prioritize capital preservation and prefer a lower level of risk may find shorter-term bonds more suitable for their investment objectives.

When selecting bonds based on maturity, investors should also consider their own financial goals and time horizon. If an investor has a specific financial goal that aligns with the maturity date of a bond, it may be more appropriate to choose a bond with a maturity date that matches their investment timeline.

In conclusion, coupon yield is influenced by factors such as interest rates and the bond’s maturity date. Understanding these factors and their impact on coupon yield is crucial for investors to make informed decisions about their bond investments. By considering these factors alongside their investment goals and risk tolerance, investors can optimize their bond portfolios for potential returns and risk management.

Calculating Coupon Yield

Step-by-Step Guide to Calculate Coupon Yield

Calculating coupon yield is relatively straightforward. Here’s a step-by-step guide to help you determine the coupon yield of a bond:

- Find the bond’s annual interest payment, also known as the coupon payment. This information can be found on the bond’s prospectus.

- Divide the annual coupon payment by the bond’s face value, which will give you the coupon yield as a decimal.

- Multiply the result by 100 to convert the decimal into a percentage.

For example, if a bond has an annual coupon payment of $50 and a face value of $1,000, the coupon yield would be (50/1000) * 100 = 5%.

Understanding the Formula of Coupon Yield

The formula to calculate coupon yield is as follows:

Coupon Yield = (Annual Coupon Payment / Face Value) * 100

By using this formula, you can calculate the coupon yield for any bond as long as you have the necessary information.

Now, let’s delve deeper into the concept of coupon yield and its significance in the world of finance. Coupon yield is a critical metric used by investors to assess the potential return on their bond investments. It represents the annual interest payment, expressed as a percentage of the bond’s face value. This metric helps investors compare the income generated by different bonds and make informed investment decisions.

When calculating the coupon yield, it is important to note that it is based on the bond’s face value, which is the amount the bondholder will receive at maturity. The annual coupon payment, on the other hand, is the fixed amount of interest paid to the bondholder each year. By dividing the annual coupon payment by the face value and multiplying it by 100, you can determine the coupon yield as a percentage.

Understanding the formula of coupon yield is essential for investors who want to evaluate the income potential of a bond. By knowing the annual coupon payment and the face value, investors can calculate the coupon yield and compare it with other investment opportunities. This allows them to assess the risk and return profile of different bonds and make informed investment decisions based on their financial goals and risk tolerance.

It is worth noting that coupon yield is just one aspect to consider when evaluating a bond investment. Other factors, such as the bond’s credit rating, maturity date, and market conditions, also play a crucial role in determining the overall attractiveness of a bond. Therefore, it is important for investors to conduct thorough research and analysis before making any investment decisions.

In conclusion, calculating coupon yield is a relatively simple process that involves dividing the annual coupon payment by the bond’s face value and multiplying it by 100. This metric helps investors assess the income potential of a bond and compare it with other investment opportunities. However, it is important to consider other factors and conduct thorough research before making any investment decisions.

Comparing Coupon Yield and Current Yield

Key Differences and Similarities

While coupon yield and current yield both provide insights into bond investments, it’s important to understand their differences and similarities.

Coupon yield represents the bond’s annual interest payment as a percentage of its face value. On the other hand, current yield represents the bond’s annual interest payment as a percentage of its market price.

The key similarity between the two is that they both provide information on the income potential of a bond. However, current yield takes into account the current market price, which can be influenced by factors such as interest rate changes and market demand for the bond.

Choosing Between Coupon Yield and Current Yield

While both coupon yield and current yield have their merits, the choice between the two depends on investors’ goals and preferences.

If you are primarily interested in estimating your potential income from a bond based on its face value, coupon yield can provide valuable insights. On the other hand, if you want to assess your potential income based on the market price of the bond, current yield may be more suitable.

Risks and Benefits of Coupon Yield

Potential Risks in Coupon Yield Investment

Like any investment, coupon yield bonds come with their own set of risks. One significant risk is the potential for default by the bond issuer. If the issuer fails to make the coupon payments or repay the principal amount upon maturity, the bondholder may suffer losses.

Additionally, bond prices can be influenced by changes in interest rates and market conditions. If market interest rates rise after purchasing a bond with a fixed coupon yield, the bond’s value in the secondary market may decrease, resulting in potential capital losses if sold before maturity.

Advantages of Investing in Coupon Yield Bonds

Despite the risks, coupon yield bonds offer several advantages to investors. First and foremost, they provide a steady stream of income through regular coupon payments. This can be particularly appealing to those seeking consistent income or looking to diversify their investment portfolio.

Bonds with coupon yields also offer the potential for capital appreciation if market interest rates decline after the bond is issued. As a result, the bond’s market price may increase, allowing investors to sell at a profit if they choose to do so before the bond matures.

In conclusion, coupon yield is an integral part of bond investments. Understanding its definition, factors that influence it, calculating methods, and its risks and benefits can help you make informed investment decisions. Whether you are a novice investor or a seasoned financial enthusiast, having a comprehensive understanding of coupon yield will undoubtedly be a valuable asset in your investment journey.